Weekly Update | June 21, 2024

Let’s hop straight into five of the biggest developments this week.

1. Chinese Industrial Production misses expectations rising 5.6%

Industrial output and fixed asset investment missed expectations this week. Industrial output grew by 5.6% year-on-year, compared to the 6% increase expected, while fixed asset investment rose 4% compared to last May, just shy of the 4.2% forecast. This data confirms that the rebound in the Chinese economy continues to be mixed.

2. Reserve Bank of Australia leaves rates unchanged at 4.35%

The RBA kept interest rates on hold for a fifth consecutive meeting as thousands of households anxiously wait for a cut. They said it would keep the cash rate target on hold at 4.35 per cent. The current rate, the highest since September 2011, has been unchanged since November 2023.

3. US retail sales rose 0.1% m/m

Retail sales increased at a slower than expected pace in May as high interest rates and inflation continued to weigh on consumers. Retail sales increased 0.1, less than the 0.3% economists had expected but higher than the 0.2% decline seen in April. This data release continues to confirm that the US consumer is slowing due to the effect of higher rates.

4. British CPI meets expectations at 2.0% y/y

UK CPI met expectations this week, as the annual reading hit 2.0%, which is back within their target range. Housing rose by 2.8% y/y. Core CPI (excluding energy, food, alcohol and tobacco) rose by 4.2% y/y. These are positive developments in the UK economy, however they stated that they think the work is not done yet to contain inflation.

5. Swiss National Bank cut rates to 1.25%

The Swiss National Bank (SNB) lowered the SNB policy rate by 0.25 percentage points to 1.25%. The has been one of the first movers in cutting rates, and surprised markets this time around, as expectations was for a hold at 1.50%. They also stated that they are willing to be active in the foreign exchange market if it becomes disorderly.

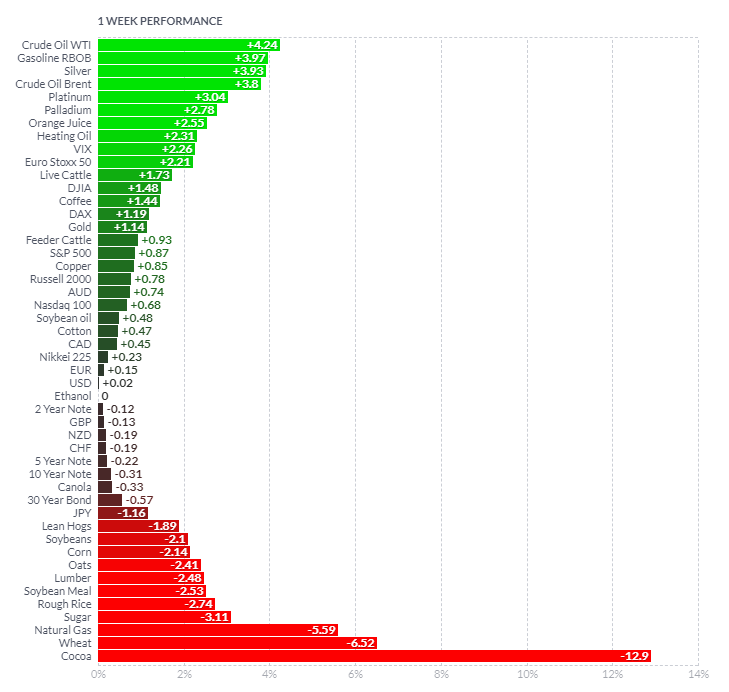

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

This week saw the energy complex rebound after a few poor weeks. Crude, Gasoline and Heating oil all finished up over +2%. Cocoa saw the largest volatility, as weather reports out of Africa were more positive than expected. Wheat sold off -6.52% as crop yields in the US were better than expected in good growing conditions. Copper finally had a week of consolidation, after seeing a significant amount of profit taking over the last 6 weeks. Finally, precious metals received some money flow, as investors allocated into these markets as they anticipated further rate cuts and looked to invest into these markets to hedge possible rises in inflation.

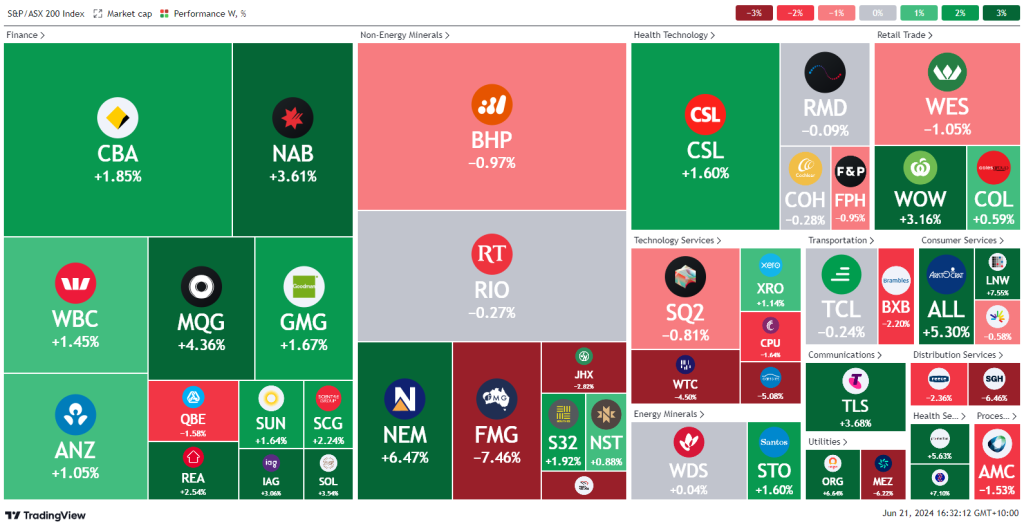

Here is the week’s heatmap for the largest companies in the ASX.

Another eventful week on the ASX as the banks continued to do the heavy lifting. BHP, RIO and FMG all continued to decline, which kept the index flat for the week. Tech had a very solid week, dragged higher by the strong performance in the US. Energy saw mild rebounds, as crude prices rebounded. STO, ORG and WDS were all up for the week.

Another eventful week on the ASX as the banks continued to do the heavy lifting. BHP, RIO and FMG all continued to decline, which kept the index flat for the week. Tech had a very solid week, dragged higher by the strong performance in the US. Energy saw mild rebounds, as crude prices rebounded. STO, ORG and WDS were all up for the week.

The Guzman y Gomez listing this week saw a first day stag of approximately 35%. On its second day of trading, it finished down -3.33%.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.