Weekly Update | March 24, 2025

1. US Retail Sales crawl up 0.2% in February, missing expectations

U.S. retail and food services sales hit $722.7 billion in February, up a modest 0.2% from January’s revised 1.2% drop. Economists expected a 0.6% rise, but growth disappointed. Annual sales climbed 3.1%, with food stores up 3.9% and online retailers soaring 6.5%. The GDP-critical control group jumped 1%, beating forecasts despite January’s downward tweak to a 1% decline, signaling mixed economic momentum.

2. Canada’s inflation jumps to 2.6% as tax break ends

Canada’s CPI climbed 2.6% year-over-year in February, up from January’s 1.9%, driven by the GST/HST tax break ending mid-month. Shelter costs rose 4.2%, while restaurant food prices eased their decline to -1.4% from -5.1%. Gasoline prices grew slower at 5.1%, tempering the surge. Monthly, the CPI rose 1.1%, or 0.7% seasonally adjusted, this reflects that broad-based price pressures are impacting Canadian households.

3. Fed Holds Rates at 4.25-4.5%, signals caution

The U.S. Federal Reserve kept the federal funds rate steady at 4.25-4.5% in March, citing solid economic growth and a stable, low unemployment rate. Inflation remains above the 2% target, prompting vigilance. The Fed will slow Treasury securities redemptions to $5 billion monthly from $25 billion starting April, while holding agency debt caps at $35 billion. Policymakers stand ready to adjust if risks threaten jobs or price stability goals.

4. Australia’s Jobs Plunge 52,800, unemployment steady at 4.1%

Australia lost 52,800 jobs in February, defying forecasts of a 30k gain, potentially due to Australians waiting to return to work after a summer hiatus. The unemployment rate held at 4.1%. Participation dropped to 66.8% from a record 67.3%, with fewer older workers returning. Full-time jobs fell by 35.7k, part-time by 17k, and hours worked dipped to 1,973 million. The employment-to-population ratio slid to 64.1%, hinting at a cooling labor market despite resilient unemployment figures.

5. Bank of Japan holds rate at 0.5%, sees inflation nearing target

The Bank of Japan unanimously kept the overnight call rate at 0.5% in March, citing moderate economic recovery. CPI inflation (excluding fresh food) hovered at 3.0-3.5%, driven by rising wages and fading energy subsidies. With exports flat and consumption growing, the BoJ expects underlying inflation to rise gradually, nearing the 2% target by late 2025, fueled by a strengthening wage-price cycle amid accommodative conditions.

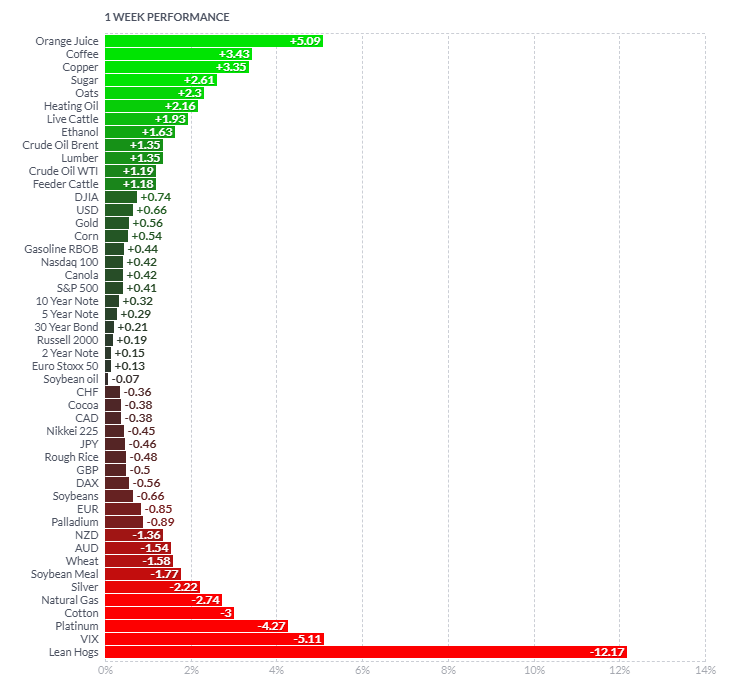

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Last week we saw a reduction in the volatility seen across various commodity and financial markets. Orange Juice (+5.09%) surged due to supply concerns from weather-related disruptions near Florida. Coffee (+3.43%) and Copper (+3.35%) gained on strong demand and supply disruptions in Brazil. The energy complex of Crude Oil (+1.35%) and WTI (+1.19%), rose on cooler weather conditions, however nothing out of the ordinary was seen here. Lean Hogs (-12.17%) plunged amid oversupply concerns and a lack of building approvals. VIX (-5.11%) dropped as market volatility eased. Platinum (-4.27%) and Natural Gas (-2.74%) fell on weak industrial demand. Silver (-2.22%) declined as the dollar strengthened. Overall it was a week that lacked some of the volatility seen in prior weeks.

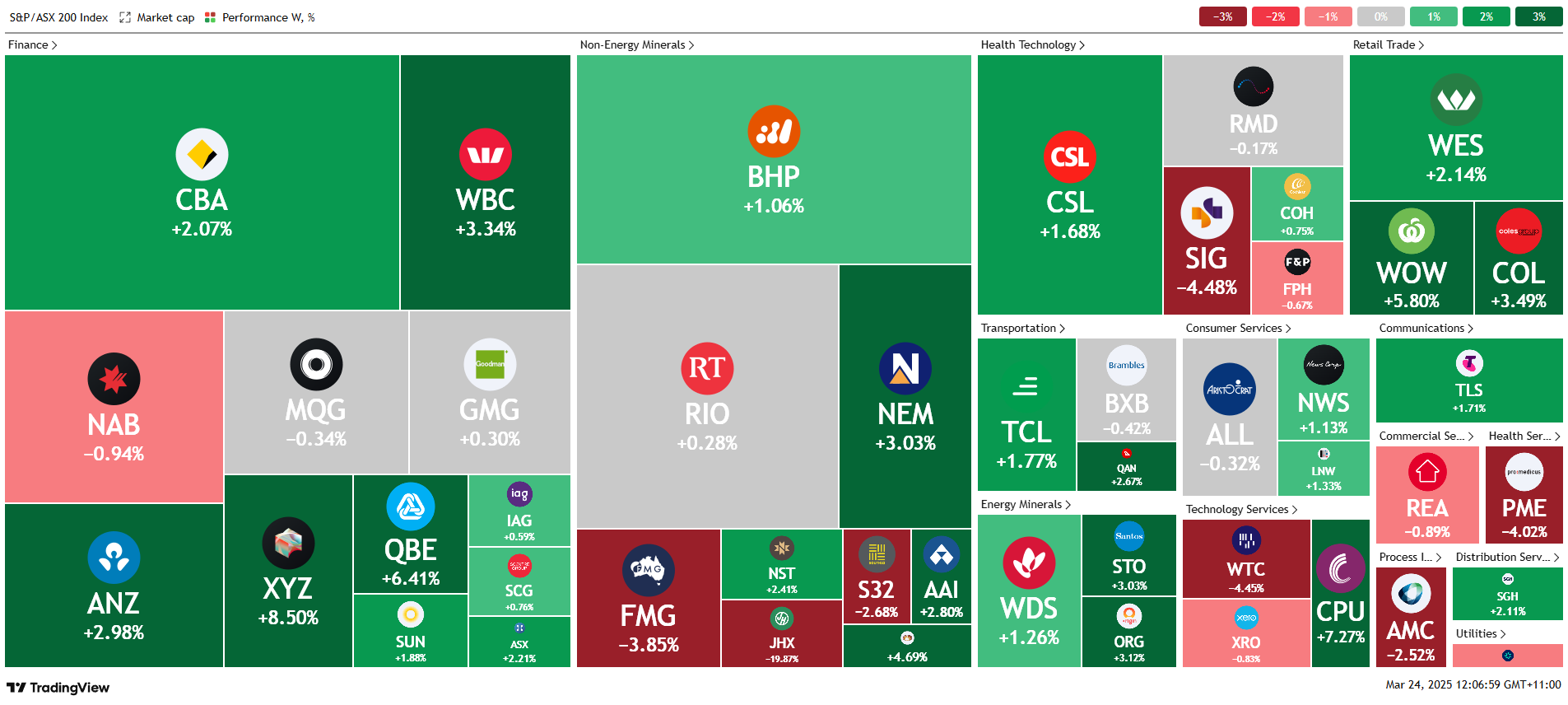

Here is the week’s heatmap for the largest companies in the ASX.

After a bruising few weeks, the ASX managed to bounce somewhat off lows. CBA, WBC and ANZ led the way as they all rose >2%. NAB was the worst performing bank, as it dropped -0.94%. Miners continued to gradually move higher, however this week saw FMG decline as the iron ore price dragged it lower. Defensive names such as WES, WOW and COL all rebounded well as they added +2.14%, +5.80% and +3.49%. Seems like investor flow based on yield, as rate cut expectations continue to build. JHX was the worst performer of ASX large cap names as there was news out about the $14bn acquisition of a US building products business AZEK.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.