Weekly Update | March 3, 2025

1. US Personal Consumption Expenditures (PCE) Price Index rose 0.3%

The PCE Price Index rose 0.3% month-over-month in January 2025, with the year-over-year rate hitting 2.5%, up from 2.4% in December 2024. Core PCE (excluding food and energy) increased 0.3% MoM and 2.6% YoY, slightly above the Fed’s 2% target. This is important as it is the Fed’s preferred inflation gauge, a 2.6% YoY Core PCE signals persistent price pressures, potentially delaying rate cuts.

2. US Gross Domestic Product (GDP) misses estimates of 2.4%

Q4 2024 GDP growth was revised to 2.2% annualized from the initial 2.3% estimate, below the consensus forecast of 2.4%. Consumer spending contributed 2.8 percentage points, offset by a -0.5% drag from inventories. This weaker-than-expected revision suggests slowing momentum in the world’s largest economy, which is contradictory to some inflation led data points.

3. China Manufacturing PMI expands as it hit 50.2 vs the 49.9 expected

The National Bureau of Statistics reported a Manufacturing PMI of 50.2 for February 2025, up from 49.1 in January. A reading above 50 indicates that the Chinese economy is gradually expanding as the government attempts to stimulate the domestic economy with solid fiscal spending plans.

4. Australian CPI steady at 2.5%

Australia’s headline inflation held steady at 2.5%, unchanged from December. However, the “trimmed mean” inflation, the Reserve Bank’s key underlying measure, edged up to 2.8% from 2.7%, which signaled a slight uptick in persistent price pressures. While headline prices stabilized, the rise in underlying inflation suggests stickier cost trends. Over the next six months, this could prompt the Reserve Bank to maintain or tighten monetary policy, potentially slowing economic growth to curb inflation.

5. US durable goods orders rose to 3.1% vs 2.0% expected

US durable goods orders rose $8.7 billion, or 3.1%, to $286.0 billion, rebounding from two months of declines. Excluding transportation, orders were flat, but excluding defense, they climbed 3.5%. This uptick signals renewed manufacturing demand, which suggests the US economy could see modest growth over the next six months, bolstered by an industrial recovery.

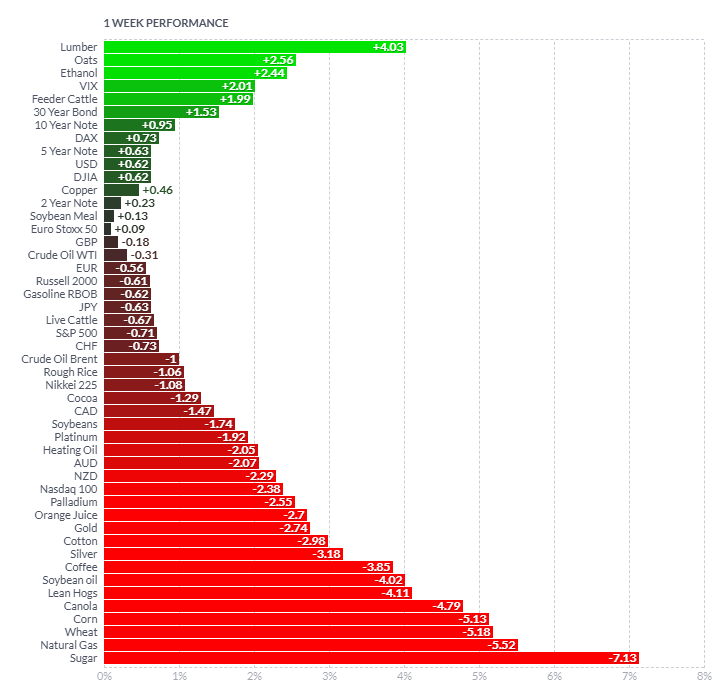

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the last week, the financial markets displayed significant volatility, with agricultural commodities and energy products experiencing the most substantial declines, while bonds and some commodities saw gains. Lumber led with a +4.03% increase, followed by oats at +2.56% and ethanol at +2.44%. In contrast, natural gas plummeted by -7.13%, wheat dropped -5.18%, and corn fell -4.79%, after changes in demand and supply expectations occurred over the week. Major stock indices like the Nasdaq 100 (-2.38%), S&P 500 (-0.71%), and DJIA (-0.46%) saw modest declines due to economic data and future expectations for interest rate cuts. Currencies such as the AUD (-2.29%) and NZD (-2.02%) weakened significantly after mixed economic data. Bonds, including the 30-Year Bond (+1.53%) and 10-Year Note (+0.95%), performed well, which indicated a flight to safety.

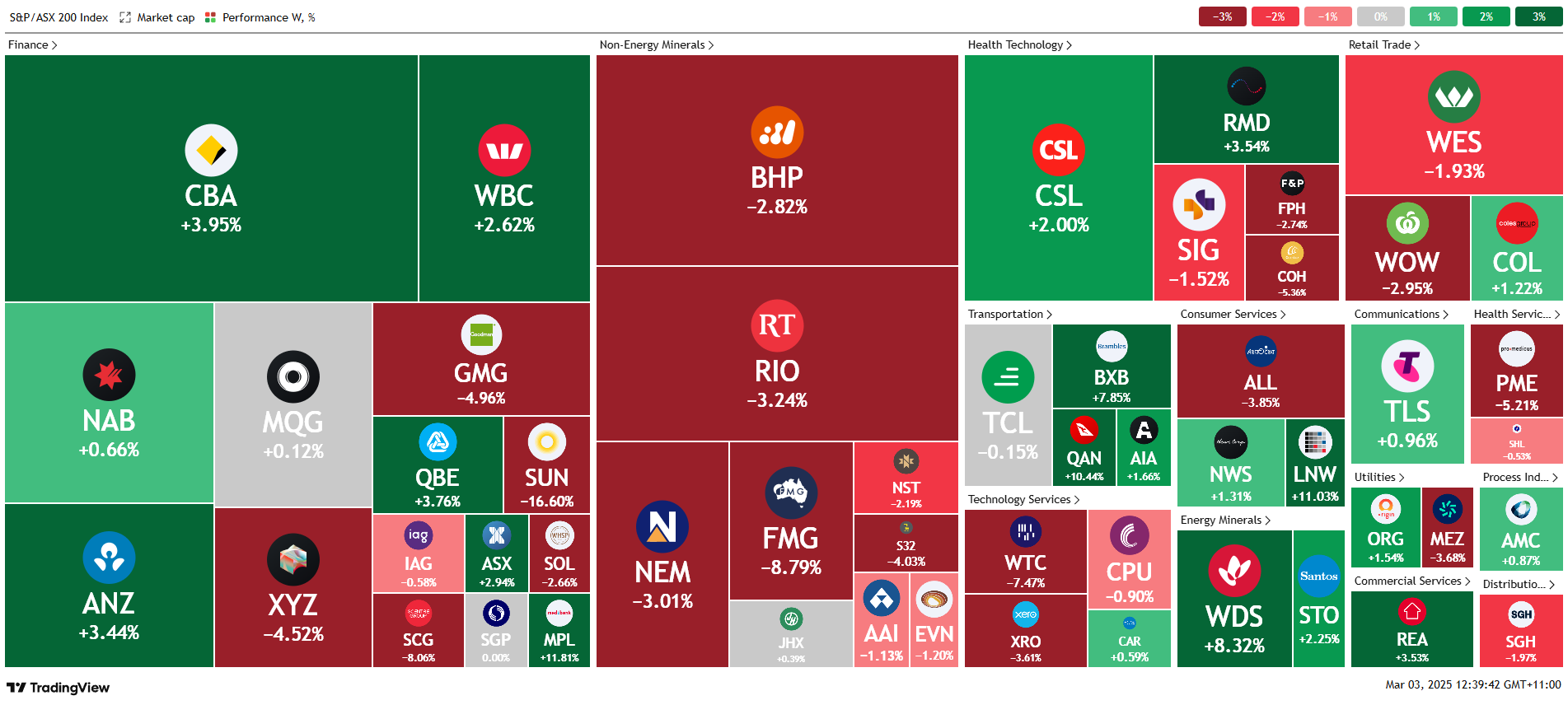

Here is the week’s heatmap for the largest companies in the ASX.

The Australian market displayed mixed results, with gains in finance and health technology, but losses in non-energy minerals and retail trade. In financials, CBA +3.95%, WBC +2.62%, NAB +0.66%, and ANZ rose +3.44%. The rebound was welcomed by investors after a brutal two weeks. Materials saw steep declines, with BHP down -2.82%, RIO -3.24%, and FMG -8.79%. They sold off as commodity price pressures due to Chinese & US relations soured. Retail trade weakened, with WES dropping -1.93% and WOW -2.95%. Defensive names such as Transurban & Telstra were flat to higher. The data suggests sector-specific challenges, with mining hit by global commodity declines due to the on-going trade talk, while defensive sectors like finance and utilities thrived.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.