Weekly Update | March 17, 2025

1. Chinese CPI y/y -0.7% vs the previous reading of 0.5%

China reported a month on month decline in their CPI reading of -0.7% which once again confirmed why the Chinese Government and the People’s Bank of China are stepping up their attempt to boost their economy. The next 6 months will be very fascinating to see if their actions result in a boost in economic growth.

2. United States Job openings expand to 7.74M

The US job market remained stable in January, with 7.7 million job openings, 5.4 million hires, and 5.3 million separations. Quits and layoffs showed little change, which signaled steady employment conditions. Over the next six months, this suggests a resilient labor market, with businesses maintaining staffing levels, potentially leading to moderate wage growth and steady consumer spending.

3. United States CPI slows to 0.2% m/m vs 0.3% expected

US inflation slowed in February, with CPI rising 0.2% after a 0.5% increase in January. The annual rate reached 2.8%, with shelter costs contributing significantly. Over the next six months, easing inflation could support consumer confidence, but persistent housing costs may strain budgets. Looking forward, this weak data may encourage the FOMC to cut rates further.

4. Bank of Canada cuts rates to 2.75%

The Bank of Canada cut interest rates to 2.75%, the lowest since 2022, citing economic uncertainty from new US tariffs. Governor Macklem warned of severe potential impacts, with businesses and consumers already cautious. Over the next six months, lower rates may support growth, but ongoing tariff uncertainty could weaken investment, hiring, and overall economic momentum.

5. UK GDP contracts by -0.1% m/m

UK’s real GDP declined by -0.1% in January after growth in December and November, with services expanding but production contracting. Over the past three months, GDP grew 0.2%, supported by services and construction. Looking forward, the slow down in GDP may provide a further catalyst for further rate cuts in the short term.

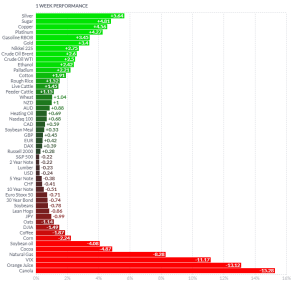

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Recent commodity price movements have responded to recent commodity movements. The U.S. imposed 25% tariffs on steel and aluminum, which drove silver (+5.64%), gold (+3.4%), and copper (+4.56%) higher as investors sought safe-haven assets. Crude oil (+2.5%) and gasoline (+3.45%) rose due to a 5.7-million-barrel supply drop and rising demand. Meanwhile, canola (-15.28%) and orange juice (-13.12%) fell sharply, due to improved growing conditions. Trade tensions raised costs for builders, which impacted industrial commodities. The VIX (-11.17%) declined as equity markets rallied to close the week.

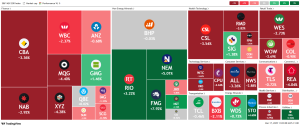

Here is the week’s heatmap for the largest companies in the ASX.

We saw another aggressive week of selling in the vast majority of the Australian market. Financials let the broader market lower, with CBA, QBC, NAB and MQG all down over -2.3%. Materials were the bright spot, with NEM, FMG and RIO all rising over +3.0%. Staples, Healthcare and Tech all saw broad declines, as the market continued to be sold off after further news about Tariffs, and a general downgrade to earning estimates domestically.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.