Weekly Update | March 31, 2025

1. US business activity gains momentum, rising to 53.5

US business activity gained momentum in March, with the PMI Composite Output Index rising nearly two points to 53.5, a three-month high. This rebound followed a 10-month low in February but remained below December’s peak. Growth was driven by a recovering services sector, which saw its strongest expansion this year due to improved demand and better weather. However, subdued exports and weak manufacturing weighed on overall performance. Looking ahead, economic growth may remain moderate amid policy uncertainty and rising costs.

2. Australian CPI rose 2.4% for the year

Australia’s monthly CPI indicator rose 2.4% in the year to February, slightly easing from 2.5% in January. Key contributors were food and non-alcoholic beverages (+3.1%), alcohol and tobacco (+6.7%), and housing (+1.8%). Excluding volatile items, inflation was 2.7%, down from 2.9% in January. This moderation suggests inflationary pressures are easing but remain persistent in essential categories. Over the next six months, steady inflation could keep the Reserve Bank cautious on rate cuts.

3. US Final GDP q/q improved to 2.4% vs 2.3% expected

The U.S. economy grew at an annualized rate of 2.4% in Q4 2024, down from 3.1% in Q3, driven by higher consumer and government spending but partially offset by declining investment. A drop in imports also contributed to growth. While steady consumer activity supports economic resilience, weaker investment signals caution. Looking forward, this slowdown may continue amid policy uncertainty and rising costs, potentially leading to tempered business expansion and a more cautious Federal Reserve stance on interest rates.

4. US personal consumption price index rose 0.4% m/m

In February, US personal income rose by $194.7 billion (0.8%), while disposable income grew 0.9%, which outpaced a 0.4% increase in personal consumption expenditures. Personal outlays climbed $118.4 billion, which reflects steady spending despite economic uncertainties. This is the first time PCE has beaten expectations since May 2023.

5. Trump launches a 25% tariff on imported vehicles

On Thursday, Trump launched fresh tariffs on autos produced outside of the US, this also includes parts. In another step to ‘Make America Great Again’, the step is expected by most analysts to drive vehicle prices by in excess of $3000 on average. One beneficiary of the tariff is Telsa (surprise surprise), as they produce the majority of their vehicles in the US.

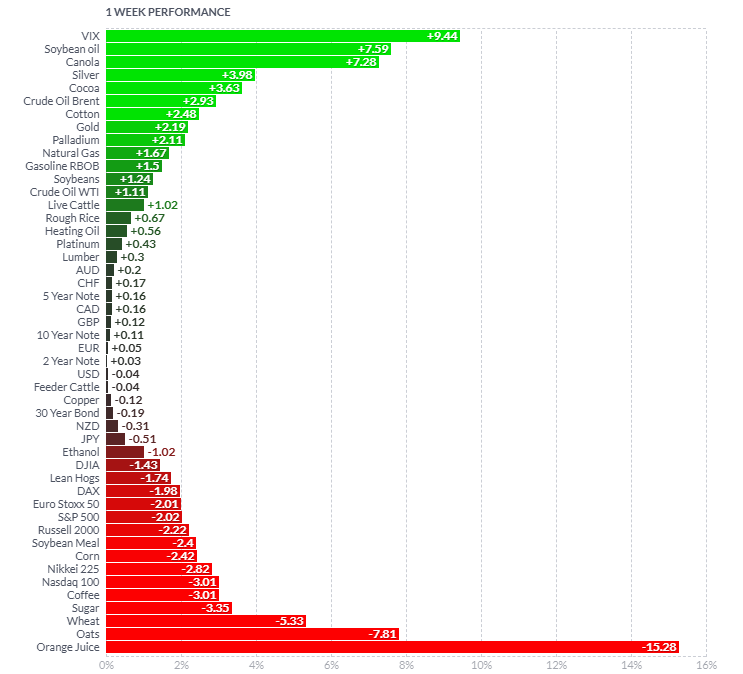

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

A week of slightly more volatility was seen with the Nasdaq, Nikkei and the S&P 500 all down a bit over -2%. There was some profit taking in commodity markets, with Coffee, Sugar and Orange Juice all declining by -3.01%, -3.35% and -15.28% respectively. There were no real drivers here, other than investors taking profit after solid moves recently. The energy complex was a bright spot, with Crude, RBOB and Natural Gas rising by +2.93%, +1.67% and +1.5% respectively. Once again, no real news here. The VIX jumped by 9.4% as equity markets saw continued selling pressure after the announcement of further tariffs, and the potential impact on an economic growth slow down.

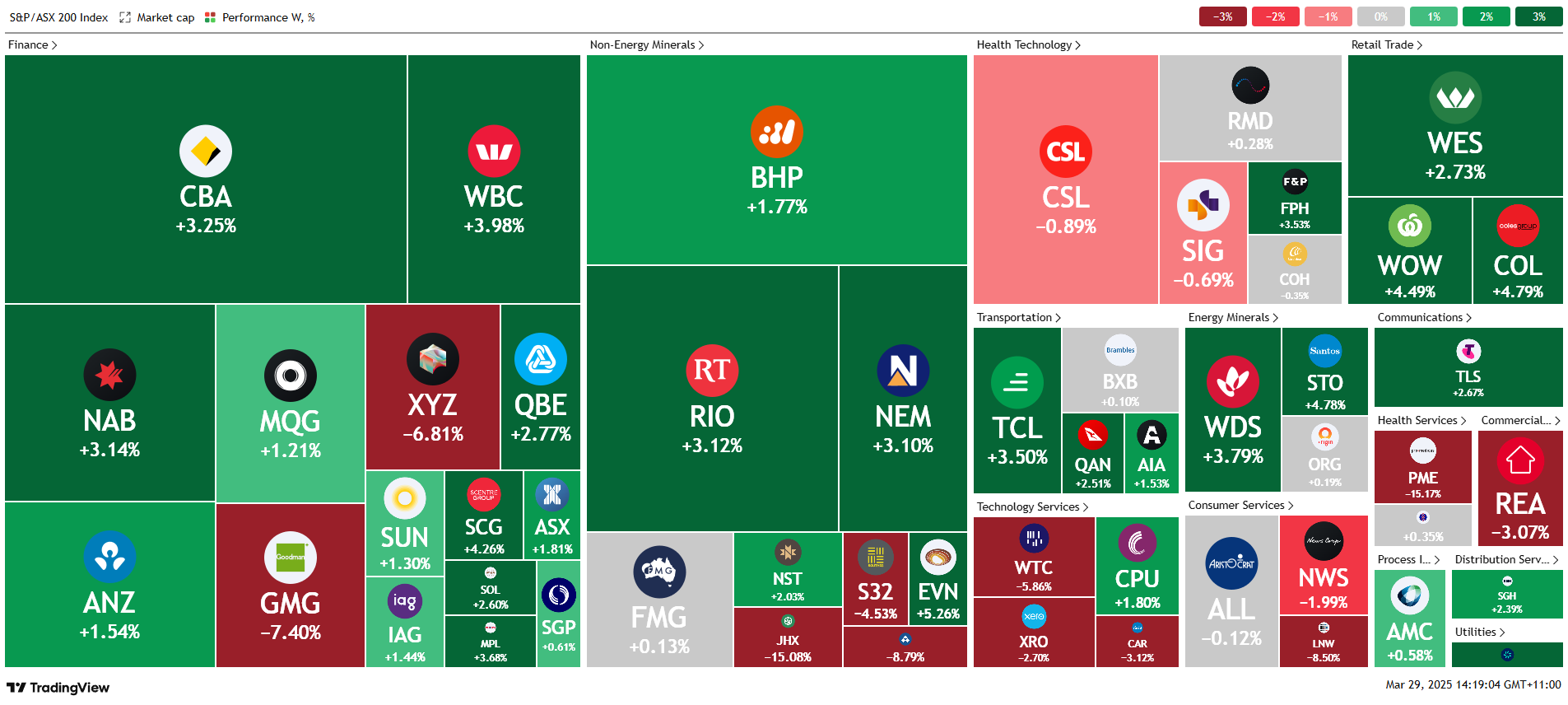

Here is the week’s heatmap for the largest companies in the ASX.

Last week we saw a solid rebound in most parts of the Australian market, however there were still some pockets that continued to decline. The broader market is still in a bearish state, so some of these moves may be short lived. Australian Tech was the worst performing sector, with WTC, CAR, XRO and XYZ all down over -2.5%. XYZ the worst, as it declined by -6.81%. Materials continued to show strength, with BHP and RIO rising +1.77% and +3.12% respectively. Financials saw a good week of inflow, with CBA, WBC and NAB all rising >3%. Consumer staples also had a solid week, as WES, WOW and COL all rose, it seemed investors were searching for higher yielding investments.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.