Weekly Update | June 15, 2024

Let’s hop straight into five of the biggest developments this week.

1. UK Claimant count increases to 50.4K

The UK labour market continued to slow this month, as unemployment and the number of unemployment change rose. The positive however was that earnings growth remained relatively strong.

2. Chinese CPI missed expectations rising 0.3% vs 0.4% expected

Chinese CPI rose 0.3% year-on-year in May, data showed on Wednesday. The reading was weaker than expectations for a rise of 0.4% and remained unchanged from the prior month. The reading comes as Chinese consumer spending remained largely under pressure from persistent concerns over the Chinese economy, which saw consumers drastically scale back discretionary spending over the past year.

3. US Core CPI m/m remains static at 0.0% m/m

The consumer price index didn’t show an increase in May as inflation slightly loosened its stubborn grip on the U.S. economy, as a broad inflation gauge that measures a basket of goods and services costs across the U.S. economy, held flat on the month though it increased 3.3% from a year ago. This continues to demonstrate that higher interest rates are continuing to work their way through consumer prices.

4. US Federal Reserve held rates 5.50% steady

On Wednesday, the US Federal Reserve kept its key interest rate unchanged and signalled that just one cut is expected before the end of the year. With markets hoping for a more accommodative central bank, Federal Open Market Committee policymakers following their two-day meeting took two rate reductions off the table from the three indicated in March. In some parts this is hawkish, but markets perceived the FOMC meeting to be dovish.

5. US Producer Price Index declined by -0.2%

US PPI declined by -0.2% for May. A decrease in final demand prices can be attributed to a 0.8-percent decline in the index for final demand goods. Food rose 3.2% over the last twelve months, while final demand goods can be traced to a -7.1% decline in prices for gasoline.

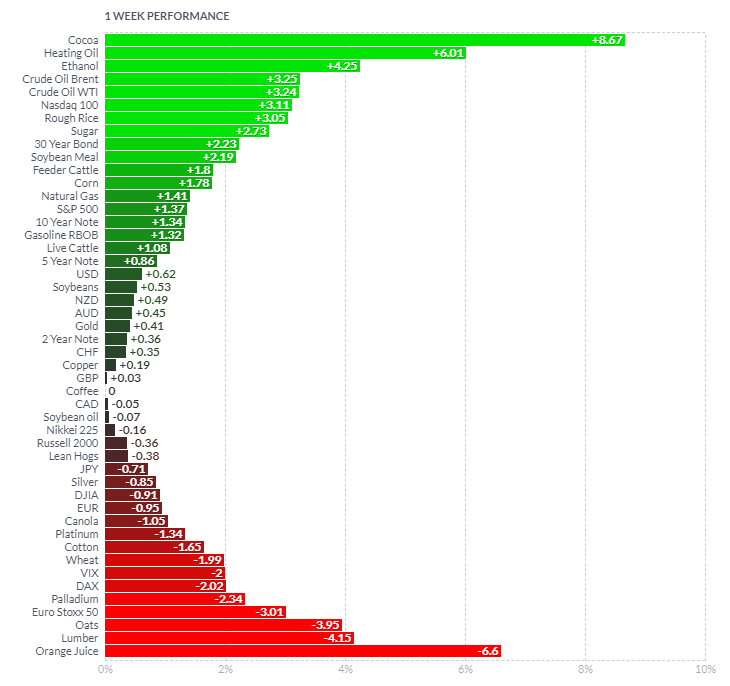

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the course of the week there has been relatively quiet action in the commodity markets. Cocoa, and the energy complex continued to move higher after recent solid performance due to growing conditions out of Brazil, while the energy complex continued to rise due to colder weather forecasts. Orange juice, lumber and oats had a period of declines as traders continue to take profit after solid runs over the last 3 months. Equity markets were once again solid, as the interest rate stance from central banks continued to be dovish.

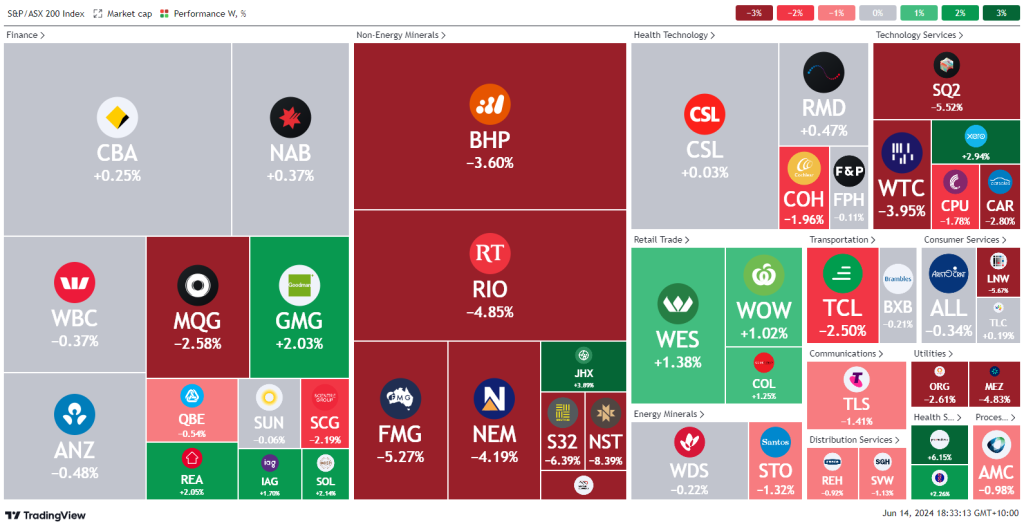

Here is the week’s heatmap for the largest companies in the ASX.

Over the last week, Australia banks continued to be weak, however were consolidating at recent highs. CBA, NAB, WBC and ANZ were mixed with half up and half down. MQG declined by -2.58%, after profit taking, while GMG had a solid week of performance. Consumer staples were solid with WES and WOW up +1.38% and +1.02%. The worst performing sector of the week was by far the materials sector, BHP, RIO, FMG and NEM were very poor as commodity prices continued to sell off consistently over the course of the week. Iron ore continued to sell off, however it did manage to rebound on Thursday and Friday.

Over the last week, Australia banks continued to be weak, however were consolidating at recent highs. CBA, NAB, WBC and ANZ were mixed with half up and half down. MQG declined by -2.58%, after profit taking, while GMG had a solid week of performance. Consumer staples were solid with WES and WOW up +1.38% and +1.02%. The worst performing sector of the week was by far the materials sector, BHP, RIO, FMG and NEM were very poor as commodity prices continued to sell off consistently over the course of the week. Iron ore continued to sell off, however it did manage to rebound on Thursday and Friday.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.