Weekly Update | January 19, 2024

Let’s hop straight into five of the biggest developments this week.

1. UK claimant count change rose to 11.8k

The UK labour market performed better than expected in December despite longstanding headwinds. While the claimant count change rose to 11.8k from the previous downward revised figure of 0.6k, the rise was much less than the gloomy 18.1k markets expected. It remains to be seen if the festive over-performance was merely seasonal or of this is a sign of structural resilience moving forward.

2. Canada’s trimmed CPI rose to 3.7% y/y

Inflationary pressure in Canada is on an upward trajectory and more endemic than previously estimated. In the twelve months to December, the trimmed CPI rose to 3.7% from the previous 3.5%. This came as a surprise to markets that had priced into a reduction to 3.4%. Economic analysts will be forced to review their interest rates cut expectancy for 2024 as price elevation in Canada remains a work in progress.

3. Chinese industrial production grew 6.8% y/y

The post Covid-19 recovery of the turbulent Chinese industrial sector is slowly gaining momentum. Industrial production grew 6.8% in the year to December, beating pessimistic market forecasts of 6.6%. We interpret this to show that the stimulus policies of Chinese authorities are beginning to take effect on industrial output, albeit slowly.

4. UK CPI rose 4% y/y

Inflation in the UK is more widespread than initially thought. CPI rose 4% in the year to December from the previous reading of 3.9%. This was a deviation from market expectations of a further slowdown to 3.8%. Rising energy prices largely underpin the resurging inflationary pressure.

5. US retail sales rallied 0.6% m/m

The US retail sector grew for a third consecutive month to mark a solid end to the festive season. Retail sales grew 0.6% in December, outperforming the previous figure of 0.3%. The American consumer remains undaunted by restrictive monetary policies.

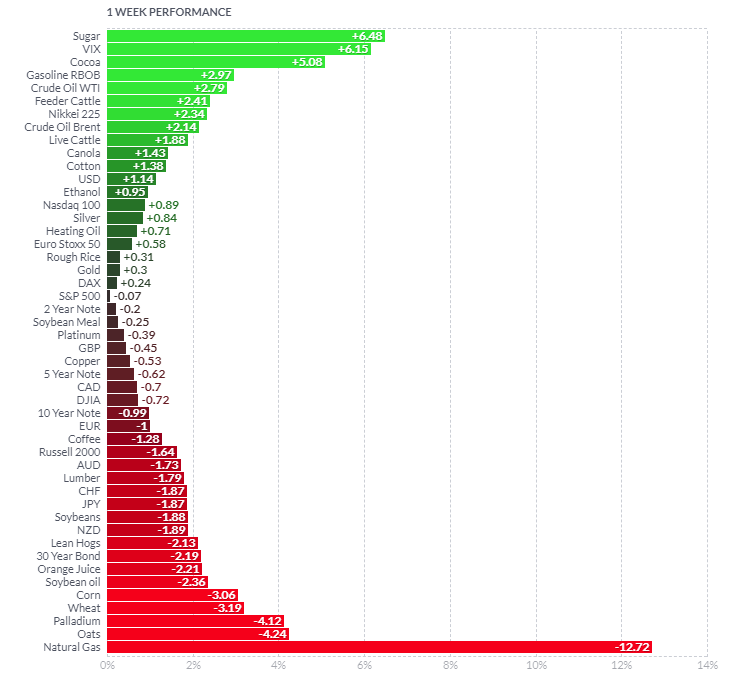

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The VIX rose markedly on heightened geopolitical risk after Iran and Pakistan traded missiles. These hostilities renewed market fears of a regional outburst. The energy complex held strong from supply chain disruptions, most exporters re-routed ships from the critical Red Sea route. Demand soared after a 2.2million barrel shortfall in US stockpiles. Sugar rose on supply concerns that the ongoing El Nino weather pattern will adversely affect production while cocoa was up on seasonality. Natural gas, cereals and orange juice fell on oversupply, while livestock rebounded on favorable and improving weather.

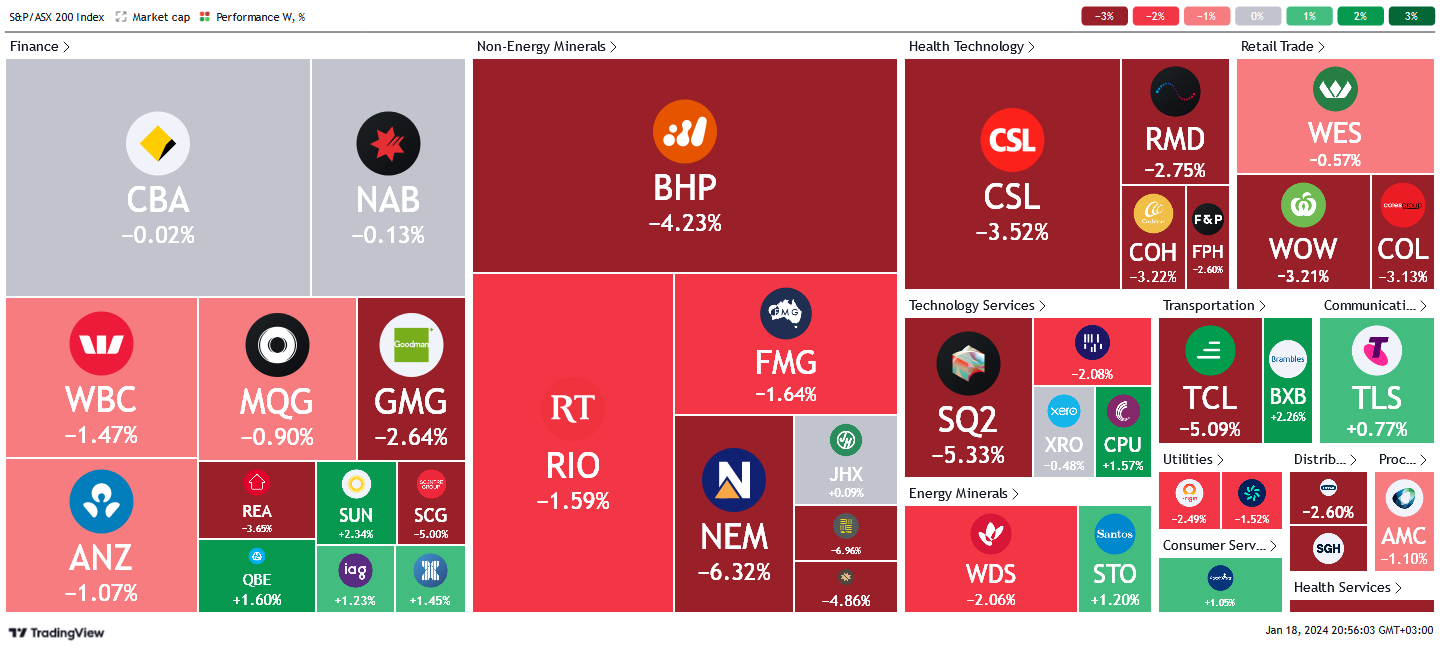

Here is the week’s heatmap for the largest companies in the ASX.

A dismal week for the ASX as most sectors has experienced large losses. The financial sector was better than most, posting mixed results that leaned to the downside. SGP and SCG led the selling to close down – 5.99% and – 5% respectively. MPL and SUN propped the index to counter the selling pressure with relative strength, closing up +2.43% and +2.34% respectively. Non energy miners were a total bloodbath with all but one stock in the red. MIN and S32 led the wipeout to close – 7.95% and – 6.96% respectively. JHX held out with a meagre +0.09% gain. Healthcare, retail and technology services were all red while transportation and energy miners were mixed.

A dismal week for the ASX as most sectors has experienced large losses. The financial sector was better than most, posting mixed results that leaned to the downside. SGP and SCG led the selling to close down – 5.99% and – 5% respectively. MPL and SUN propped the index to counter the selling pressure with relative strength, closing up +2.43% and +2.34% respectively. Non energy miners were a total bloodbath with all but one stock in the red. MIN and S32 led the wipeout to close – 7.95% and – 6.96% respectively. JHX held out with a meagre +0.09% gain. Healthcare, retail and technology services were all red while transportation and energy miners were mixed.

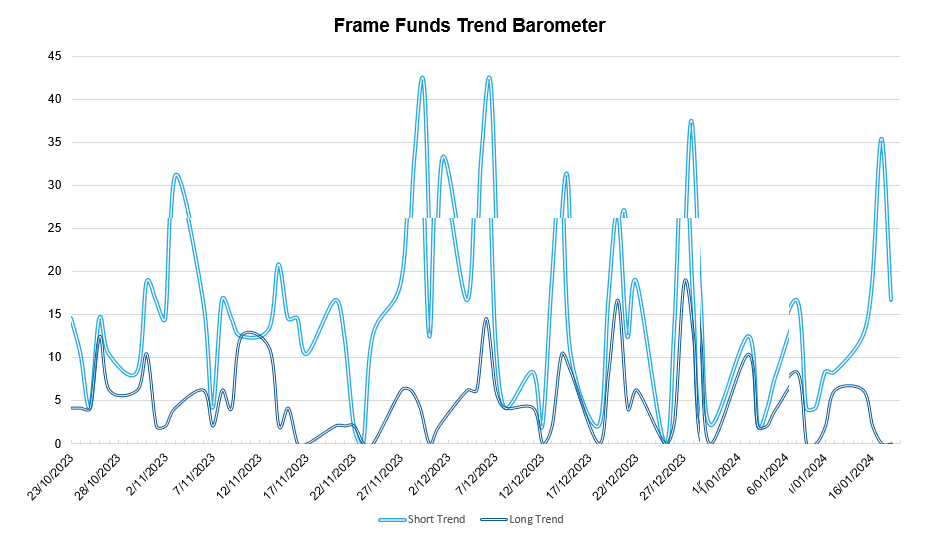

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.