Over the second half of 2021, the Frame Long Short Australian Equity Fund core portfolio underwent a significant reorientation. The systematic system exited positions in materials businesses in response to the Chinese economic slowdown and has since become a more diversified portfolio. The new investment themes the Fund has allocated into include high inflation/rising interest rates, supply chain stress and rare earth/battery metal undersupply. Below is a selection of companies which the Fund has purchased to capture the themes mentioned above.

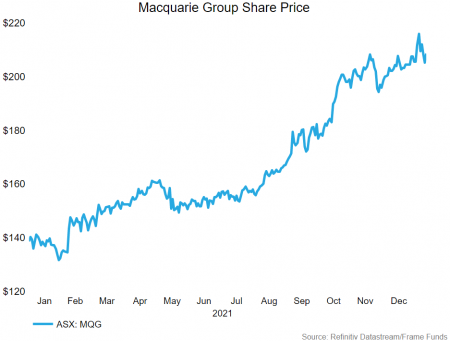

Macquarie Group (ASX: MQG)

Macquarie has been a standout of the Australian financial sector in FY22. After logging solid 2021 financial year and 2022 half year interim reports, they raised $1.5 billion to fund further growth. With new investments on the horizon and higher interest rates expected soon, Macquarie seems to be perfectly poised for further growth. Their Banking and Financial Services lines of business should experience margin growth, while their Commodities/Global Markets business should profit from the extra cash available for investment.

Macquarie’s upcoming HY22 results presentation will provide the company with a good opportunity to announce new investments and projects, especially in the green energy space.

GrainCorp (ASX: GNC)

GrainCorp provides grain storage, handling, processing, and supply services to customers in over 50 countries. The efficiency of their end-to-end supply chain infrastructure assets in the face of difficult conditions, saw the value of the company almost double over the course of 2021. In addition to strong supply chain management, solid harvest numbers and some favourable weather has meant their grain storage business continues to flourish.

Their FY21 report released in November also pointed towards profitable conditions continuing for the 2022 financial year. This included sustained strong demand for Australian grain, and the ability to store more product with their ‘flex’ sites. The next catalyst will come at GrainCorp’s AGM in February where they will provide FY22 guidance.

Lynas Rare Earths (ASX: LYC)

Lynas is a miner and producer of rare earth elements and is the world’s only significant producer of separated rare-earth materials outside of China. There are multiple tailwinds at play that have resulted in the value of the company increasing in excess of 150% in 2021.

Firstly, there is a global shortage of rare earth elements. These elements are key inputs in the manufacture of future technologies like wind turbines and electric vehicles – areas of the economy where demand is increasing rapidly. This supply/demand imbalance has made Lynas’s Mt Weld rare earth deposit significantly more valuable.

Another factor playing in Lynas’s favour is increasing tension between Western nations and China. China currently provides more than 85% of the world’s rare earth elements, so the globe is heavily reliant on a benevolent China to sustain rare earth supply. As trade wars play out and the possibility of conflict over Taiwan continues to mount, many Western countries have attempted to decrease reliance on China. As Lynas is the only significant rare earth producer outside of China, they have a monopoly on the supply of these critical minerals.

We expect both of these factors to continue to develop and Lynas to appreciate as a result.

Download the full report by clicking the image below.