Weekly Update | August 16, 2024

If you would like to watch this update rather than read it, please click the video below!

Let’s hop straight into five of the biggest developments this week.

1. Australian wage price index rises 0.8% but misses expectations of 0.9%

The seasonally adjusted wage price index rose 0.8% and 4.1% over the year. The private sector rose 0.7% and the public sector rose 0.9%. Professional, scientific and technical services, public administration and safety and construction all rose over 0.7%. We can see that employment in Australia continues to be resilient, even in the face of higher interest rates.

2. US Core Producer Price Index slowed last month, reading 0.0% m/m

US wholesale inflation slowed as expected in July, easing after an unexpected flare-up the month before. This PPI measure was up 2.2% for the 12 months, a stark pullback from the 2.7% increase registered in June. This measure shows that producer inflation continues to drop, which is a positive thing for consumer prices.

3. RBNZ surprises with a 0.25% cut

The Reserve Bank of New Zealand surprised market participants on Wednesday, as they cut their Official Cash Rate by 0.25%, decreasing their rate from 5.5% to 5.25%. This move was in response to the recession and also continue declines in CPI which is now back in line with the committee target band of 1-3%.

4. US Consumer prices were flat at 0.2% m/m

US CPI rose 0.2% m/m for both headline and core, which was inline with expectations. This measure reaffirms that the US Federal Reserve is on track to cut interest rates later this year, as their inflation continues to decline.

5. Australian unemployment rate rises to 4.2%

The unemployment rate rose to 4.2%. This was primarily in response to the participation rate increasing to 67.1%. The number of employed people increased to 14m. There was a total of 58.2k new jobs added to the economy, which continues to reflect a strong labour market, which is the opposite to what the RBA is looking for before cutting rates.

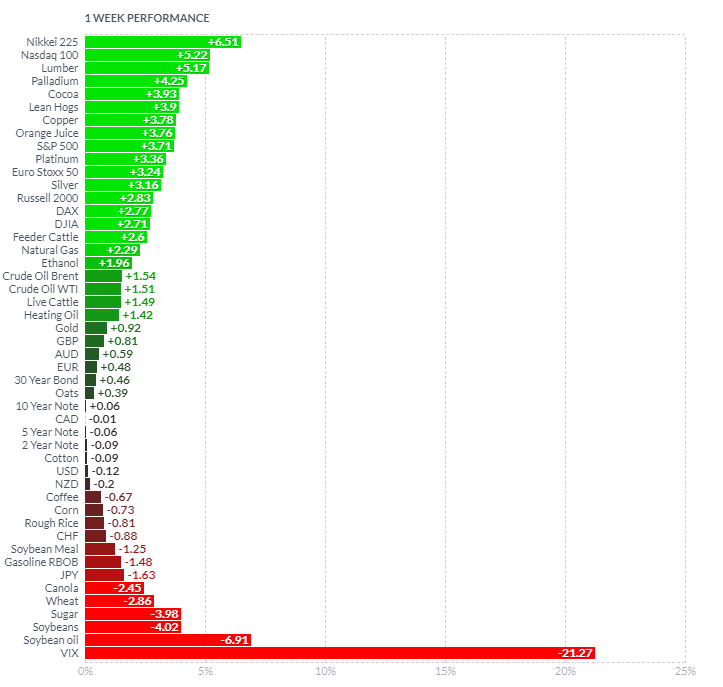

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

What a change for equities over the last week. After an aggressive sell off, caused by the Bank of Japan and growth concerns out of the US, equity markets we follow have managed to rebound swiftly. The Nikkei, Nasdaq and S&P 500 were all up over +3.5%. In response to risk leaving the market, the VIX sold off -21%. Fixed income markets were flat over the week, with the most buying in the long end. Platinum and Palladium rose on the back of industrial demand. Soft commodities were mixed, with the only outstanding performer being Cocoa and Orange Juice which were related to the growing season.

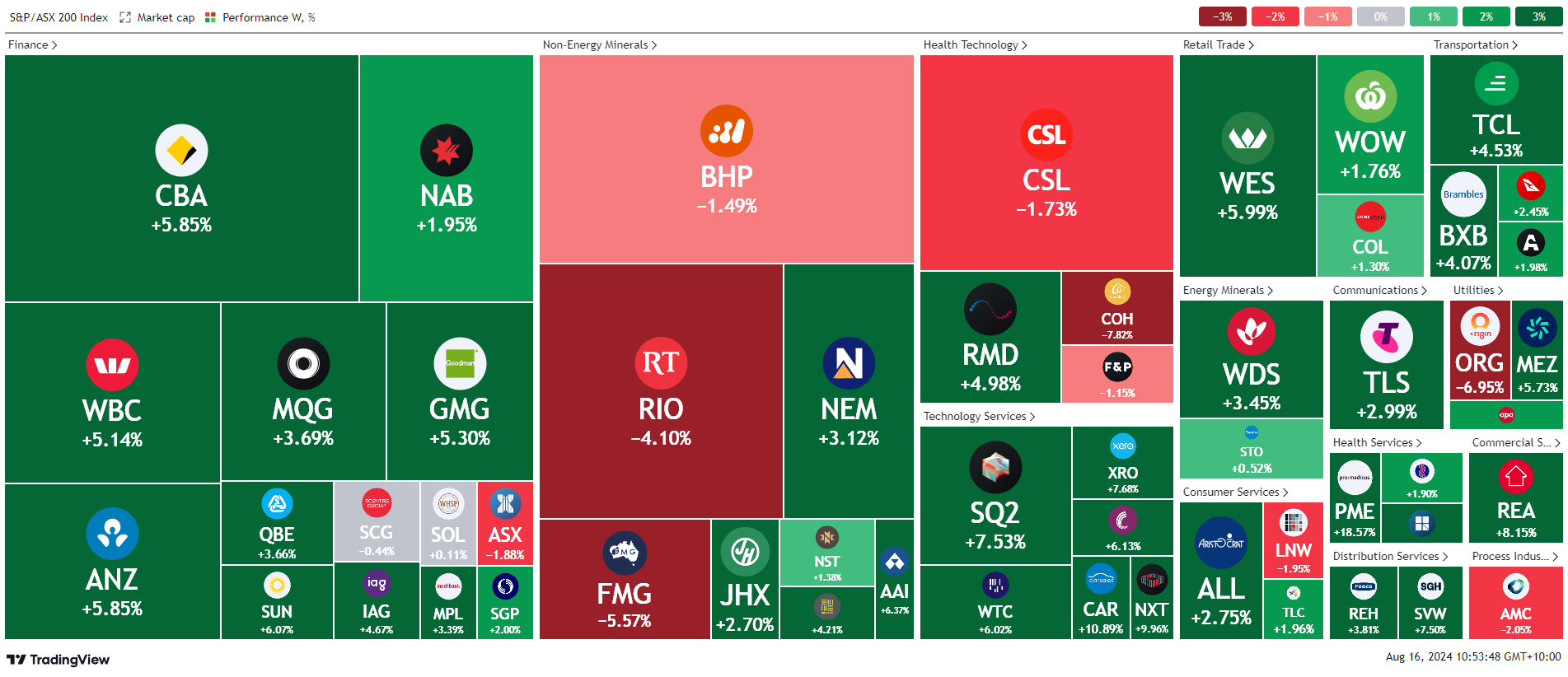

Here is the week’s heatmap for the largest companies in the ASX.

A huge week for financials, with CBA, WBC and ANZ all up over 5%, as money piled back into the market after an impulsive sell off the week before. BHP, RIO, FMG and MIN all continued to drop aggressively as iron ore prices hit multi-year lows. MIN suffered as lithium prices also continued their decline. TLS reported strong earnings, which provided a boost to their share price, while tech stocks like SQ2, WTC, CAR and NXT all rebounded swiftly, as they were supported by the rebound in the Nasdaq.

A huge week for financials, with CBA, WBC and ANZ all up over 5%, as money piled back into the market after an impulsive sell off the week before. BHP, RIO, FMG and MIN all continued to drop aggressively as iron ore prices hit multi-year lows. MIN suffered as lithium prices also continued their decline. TLS reported strong earnings, which provided a boost to their share price, while tech stocks like SQ2, WTC, CAR and NXT all rebounded swiftly, as they were supported by the rebound in the Nasdaq.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.