Weekly Update | August 9, 2024

Let’s hop straight into five of the biggest developments this week.

1. RBA leaves the cash rate at 4.35%

On Tuesday the RBA Board decided to leave the cash rate target unchanged at 4.35%. They stated that inflation remains above the target range and is proving to be very persistent. They also stated that inflation has fallen substantially since its peak in 2022, and have attributed that to supply disruptions normalizing, in combination with higher interest rates.

2. UK Construction PMI rises to 55.3 vs 52.5 expected

UK construction activity increased at the fastest pace in 26 months. Growth accelerated as the second half got underway. Firms ramped up purchasing activity and raised staffing levels for the third month running. This data point shows that recent easing of future interest rate expectations has encouraged activity to return to a slowing economy.

3. NZ Employment Change q/q 0.4% vs -0.2% expected

The New Zealand labour market showed resilience in the June quarter compared to the March quarter as it added more jobs than expected. The Unemployment rate did rise to 4.6%, up from 4.4% the quarter prior, however, was below expectations of 4.7%. This continued to show that the path of labour market and inflation normalisation is happening, but at a slower than expected pace.

4. RBA Governor Bullock disagrees with market expectations

At the conclusion of the RBA interest rate decision, mentioned above, the Governor Bullock stated that she thinks market pricing for interest rate expectations are currently incorrect. We listened in to this press conference and were happy we did, as the approach she took, and her directness was very much welcomed, rather than the political, avoid questions at all costs approach of previous Governors.

5. US reports 233k weekly unemployment claims

Initial claims for unemployment insurance totalled less than expected last week countering other signs that the labour market is weakening. Filings for jobless benefits were 233,000 for the week, a decline of 17,000 from the previous week’s upwardly revised level and lower than the Dow Jones estimate for 240K. This release provided some comfort to market watchers, as they looked for signs that the US labour market was not collapsing.

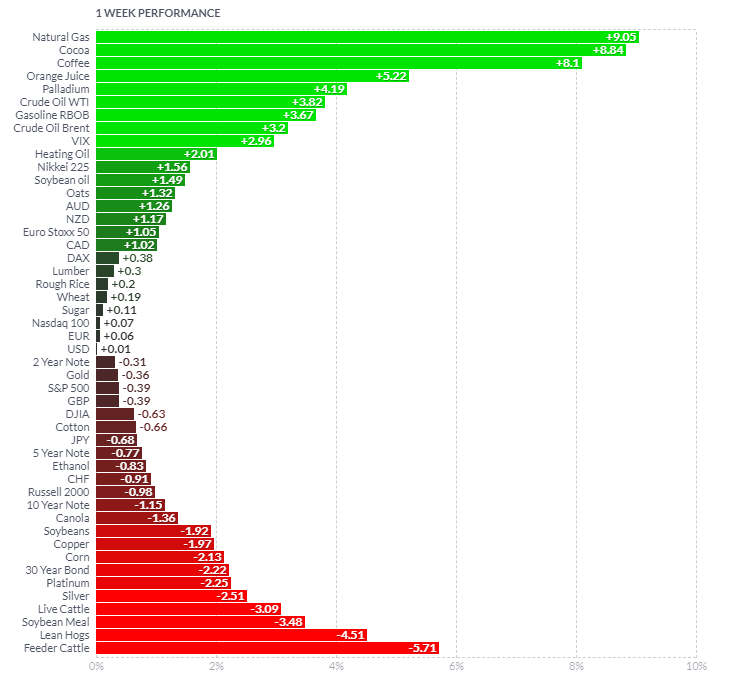

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Trends which existed earlier in the year seemed to kick back into gear over the last week, as Cocoa, Coffee and Orange Juice all rebounded. All three were caused by weather reports related to their growing seasons. Natural gas had a big bounce as weather reports for the upcoming European winter looked to be cooler than anticipated. Feeder cattle and Live cattle both sold off due to demand. Fixed income markets were generally lower, with the 10 Year US note declining by -1.12% and the 30 Year Bond dropping by -2.2%.

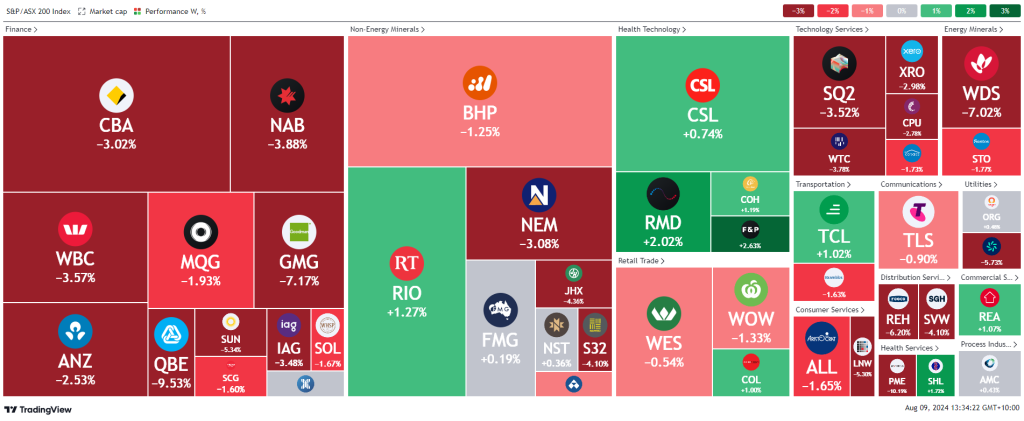

Here is the week’s heatmap for the largest companies in the ASX.

Blood on the street! What a volatile 5 days we have had. The Australian share market could not withstand the extreme moves out of the US and Japan and declined broadly over the week. The financials, led by CBA, NAB and WBC all sold off over -3%. It seemed that a lot of this selling was caused by the aggressive selling of other banking stocks across the globe, in particular Japan. Materials were reasonably strong over the week, with Copper, Iron Ore and Crude oil all holding relatively flat. Defensive names of RMD, CSL, COH, TCL and COL were all positive over the week due to their safe haven nature. WDS continued to slide through multi-year lows as they made an acquisition which was not liked by investors. Aussie tech names, SQ2, WEC, XRO and PME were all sold off heavily as the downside swing in the Nasdaq caused reciprocated selling pressure.

Blood on the street! What a volatile 5 days we have had. The Australian share market could not withstand the extreme moves out of the US and Japan and declined broadly over the week. The financials, led by CBA, NAB and WBC all sold off over -3%. It seemed that a lot of this selling was caused by the aggressive selling of other banking stocks across the globe, in particular Japan. Materials were reasonably strong over the week, with Copper, Iron Ore and Crude oil all holding relatively flat. Defensive names of RMD, CSL, COH, TCL and COL were all positive over the week due to their safe haven nature. WDS continued to slide through multi-year lows as they made an acquisition which was not liked by investors. Aussie tech names, SQ2, WEC, XRO and PME were all sold off heavily as the downside swing in the Nasdaq caused reciprocated selling pressure.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.