Weekly Update | February 24, 2025

1. RBA cuts interest rates to 4.1%

The Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points to 4.1%, marking the first reduction since November 2020. This decision was widely anticipated. The RBA cited easing inflation, with underlying trimmed mean inflation at 3.2% in Q4 2024, and increased confidence in reaching the 2-3% target range. However, the board adopted a cautious tone, noting a tight labor market, and easing wage pressures as factors tempering further cuts. The RBA reiterated any further cuts are dependent on incoming data.

2. Australian Wages soften, rising 0.7% q/q

The Q4 wage price index grew 0.7% q/q, vs expectations of 0.8%. This news was positively received by the RBA as it aligns with expectations that the heat in the labour market is gradually reducing. This opens the door to further rate cuts if the trend continues.

3. U.S. Jobless Claims steady at 219K

Thursday’s initial claims were steady at 219,000, above expectations of 215,000. Unemployment was steady at 4.1%, vs. expectations of 4.2%. This resilience was positively received by the market as it reiterates that the economic data being released from the US is not too hot, not too cold.

4. Australian labour market adds 44K new jobs

Thursday’s January data showed 44,000 jobs were added, which doubled the 20,000 expected. We continue to see ‘goldilocks’ data released regarding the Australian labour market, which doesn’t impede the current path of rate cuts. If Australian data continues to be in this not too hot/not too cold region, most upcoming RBA meetings will be live for further cuts.

5. US Flash services PMI declines to 49.7

US business activity growth came close to stalling in February, according to the most recent data, as a renewed fall in services output offset faster manufacturing growth. New order growth also weakened sharply and business expectations for the year ahead slumped amid growing concerns and uncertainty related to federal government policies. These releases all align with the stance from the US Federal Reserve, that further loosening of monetary policy may occur over the next 12 months, if data like this continues to decay.

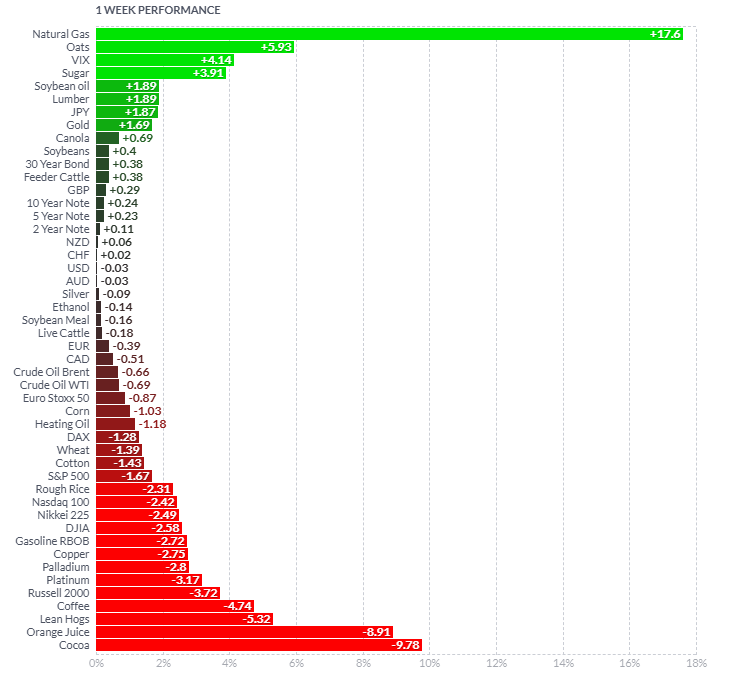

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

A choppy week for global commodities as a reversal in some key trends occurred. Natural gas led the gains with a +17.6% rise, due to increased demand due to colder weather forecasts. Oats (+5.93%) saw seasonal buying, while the VIX (+4.14%) surged as equity markets sold off. Sugar, soybean oil, and gold also performed well. On the downside, cocoa (-9.78%), orange juice (-8.91%) and coffee all saw sharp declined, as strong trends saw some profit taking. Equities such as the Nasdaq 100 (-2.42%) and S&P 500 (-1.67%) struggled. The oil complex was relatively flat.

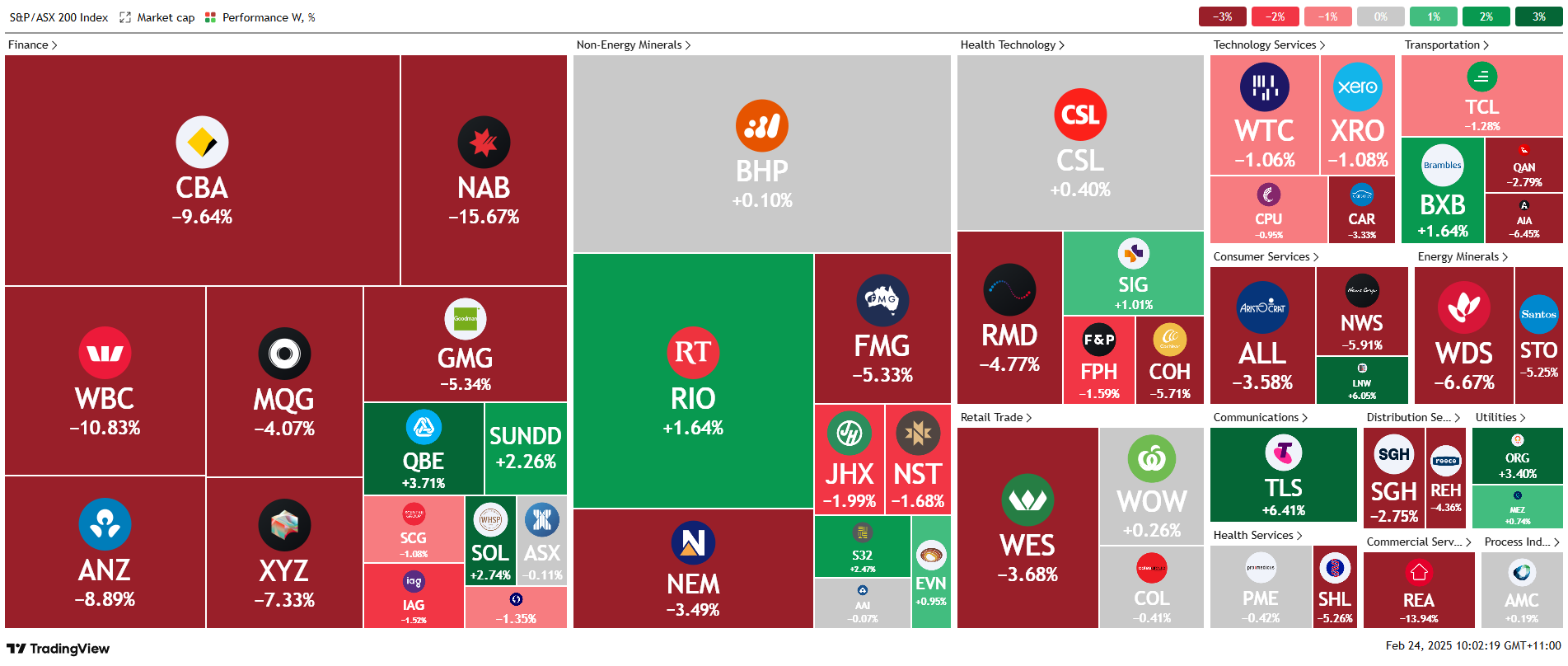

Here is the week’s heatmap for the largest companies in the ASX.

What can only be described as a brutal week for the Australian share market. The banks saw extreme selling pressure as most missed expectations as they reported their half yearly reports. The big four were sold off aggressively, NAB & WBC were down -15.67% and -10.83% respectively. CBA and ANZ were not much better, down -9.64% and -8.89% respectively. Most saw aggressively selling pressure as they missed market expectations, as lending margins contracted. The miners had a solid week (relatively), with RIO and BHP up +1.64% and 0.10% respectively. TLS & ORG were the standout performers, both up +6.41% and 3.40% respectively. REA was sold off as well as activity levels were slumping (related also to the banks) -13.94%.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.