This article is Part Two of our ‘Investing – An Alternative Approach’ miniseries. The series aims to inform readers about how the Frame Long Short Australian Equity Fund generates returns for its investors.

History is replete with examples of investing going wrong for both individuals and institutions. Anyone who has participated in financial markets will have made an investment based on a poor decision or faulty logic. Of course, hindsight is always 20/20, however that does not prevent these mistakes from happening in real-time.

In 1979 Daniel Kahneman and Amos Tversky developed Prospect Theory by observing investors actual behaviour. They began by posing 2 pairs of investments to subjects and asked which choice they would make in each case.

In a positive scenario, would you prefer:

- A sure gain of $3,000 OR a 50% chance to gain $6,000 (otherwise no gain).

In a negative scenario, would you prefer:

- A sure loss of $3,000 OR a 50% chance to lose $6,000 (otherwise no loss).

Note that in each case, the expected value of the investment is identical – when weighting the outcomes with the probability of each event occurring, the options in each case are the same.

At this point I’m sure readers have made their own choice regarding which options they would take. Kahneman and Tversky found that 84% of respondents preferred the certain $3,000 gain, a decision consistent with risk averse behaviour. In the second option, 84% of people chose the coin flip for the chance to lose nothing or $6,000 – this is consistent with risk seeking behaviour. It also implies the pain of losing is greater than the gain of winning, known as loss aversion. This behaviour was confirmed when the respondents were asked whether they would prefer either (a) no change in wealth; or (b) 50% chance of a $100 loss and 50% chance of $100 gain. The majority preferred option (a) to (b), which explains why insurance exists – people prefer to pay a small sum to avoid a low probability but high loss event.

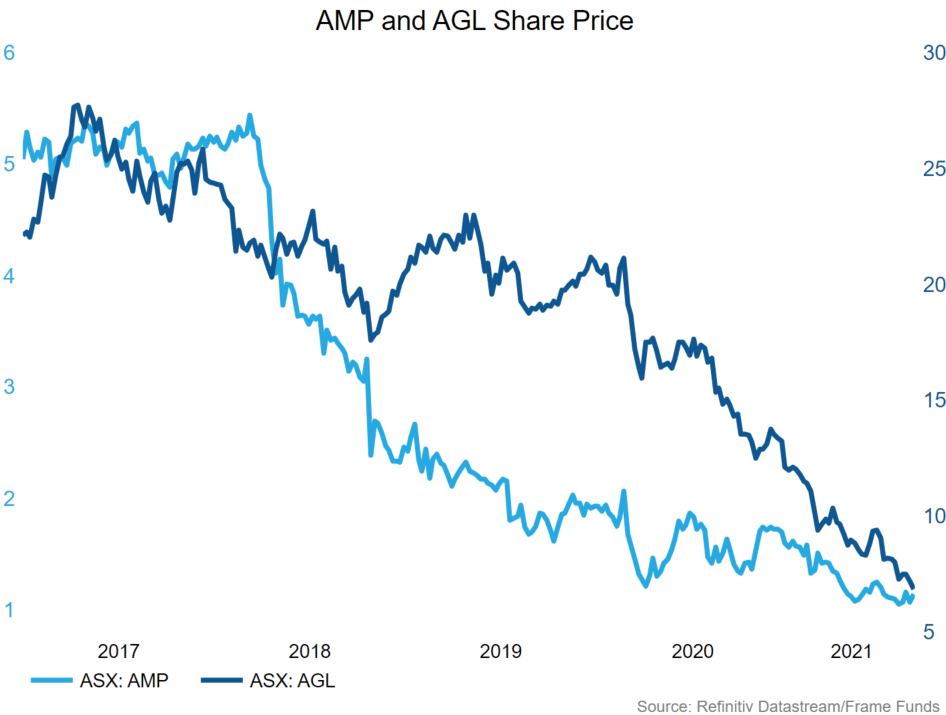

The results of these simple experiments are very telling about how most people approach financial decisions and reveal some of the irrationality humans display when investing. Another common fallacy people make when assessing investments is acting based on anchoring bias. Anchoring bias is a cognitive bias that causes people to make judgements about something based off a reference point (or anchor). Practically, this means if we see a stock trading at $1 which last month was trading at $1.50, we naturally think it is ‘cheaper’ or a ‘good buy’. The stock will be able to go back up to $1.50 simply because it has been there recently, right? Recent examples of where this flawed logic would get you into trouble are AMP Limited (ASX: AMP) and AGL Energy (ASX: AGL).

When you combine these behavioural obstacles, we as humans are always going to struggle when making investment decisions. We will not always have the time to think carefully and rationally through every buy and sell order, meaning the possibility of acting on these biases increases.

We believe the solution to this is systematic investing. Systematic investing is a rules-based approach to investment management, where the rules are determined by extensive quantitative analysis. By applying this approach, we eliminate emotion from our trading decisions, ensuring our entries and exits are based on statistically significant factors. We enter positions knowing we are exploiting our ‘edge’ over the market and exit ruthlessly without emotionally holding on to losing trades.

Part Three will discuss a variety of systematic strategies such as momentum investing and mean reversion trading. It will explore the principles guiding these approaches, how we test them and the statistical edge they provide.