2018 has been the year of swinging sentiment. Markets experienced extreme optimism (January), to extreme pessimism (February, October), and are now in the midst of a non-existent “Santa clause rally”. At the time of writing, the S&P 500 is down 7.75% this month to date. These swings in sentiment can be attributed to several things, whether it be Trump tweeting about NAFTA, Trump tweeting about Chinese trade negotiations, the United States debt ceiling, how many times the United States Federal Reserve is planning on increasing interest rates in 2018/19/20 or North Korea stopping their nuclear programme; all have played their part.

Looking ahead, 2019 looks to be another challenging year for markets globally. We attempt to outline the key themes we will be monitoring throughout 2019:

- US Interest rate path

- Implications of US-Sino trade negotiations

- European economic situation

- Emerging market performance

1. US interest rate path

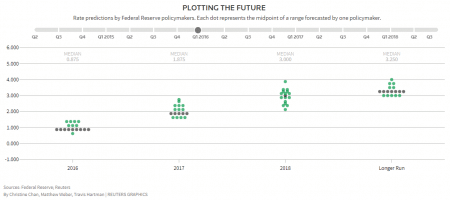

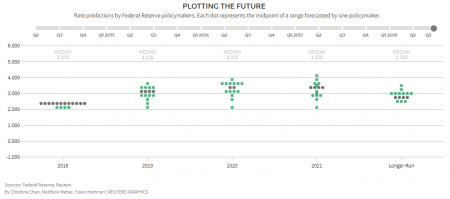

At the start of 2016, the US Federal Reserve (Fed) expected to raise rates to 3.00% by the end of 2018 (refer to Chart 2). At time of writing, US interest rates are currently sitting at 2.25%. This mismatch of expectations versus reality is consistent over history, where the Fed states they will be raising rates more aggressively than what they inevitably deliver. Heading into the month of December 2018, rates were forecasted to increase 3-4 times in 2019, bringing US interest rates to 3.00% – 3.25% (refer to Chart 3).

Our view is that these expectations for rate increases is too aggressive and the Fed will revise their expectations downwards during 2019. Although they may increase rates once again in December 2018, our view is that the Fed will cut rates during 2019 to be more accommodative considering slowing global economic growth.

2. Implications of US-Sino trade negotiations

The largest theme of 2018 has been the back and forth, threats, promises and posturing between President Trump and President Xi regarding trade. Our view is that the US has not only attempted to get the upper hand in trade to improve their trade deficit with China, they have also made the attempt to reassert the United States as the world’s powerhouse economy. With the Chinese economy growing at such a rapid relative pace to the US, Europe and Japan, inevitably, the Chinese economy will overtake the US as the world’s price maker in trade. At that stage, the US wouldn’t have the ability to call the shots as they are now. It seems that this saga has moved on from being just about trade, to reasserting their global dominance.

Looking at 2019, we expect a deal will be done on trade, however, it will occur at the expense of the global economy. By the time a deal is agreed upon, we think it will be too late, and both economies will have experienced a slow down in output and confidence. The conclusion of the expansionary phase is widely expected during 2019/20, however, our view is that it has already begun during 2018, with the US-Sino trade negotiations providing the catalyst.

3. European economic situation

From an economic perspective, there are very few positives that can be taken from the current situation in Europe.

The most recent manufacturing data released from Europe has signalled expansion, however at a contracting rate. France, in particular, has seen an absolute contraction in manufacturing and services PMI data, showing a reading of 49.7 and 49.6 vs 50.7 and 54.8, respectively (a reading greater than 50 is expansionary and less than 50 is contractionary). With Europe being an exporting nation and their output directly relating to GDP, this is a concerning sign for the region.

European gross domestic product (GDP) was materially revised down to 2.2% for 2018, 2.0% for 2019 and 1.8% for 2020 by the International Monetary Fund. Once again demonstrating that the basket of European economies is slowing.

One of the key challenges the European Central Bank (ECB) is facing, is that while the US is increasing interest rates to keep their inflation in check and provide themselves a buffer during the next recession, the by-product of this is that it will slow global consumption by the US economy. With Europe being a large global exporter, any contraction in consumption from the US economy will flow through to the European output. ECB President Mario Draghi is in a predicament. He is attempting to taper their record stimulus package, whilst hoping economic growth and inflation continue to occur.

Unless Draghi aggressively reverses his plan to wind back their record stimulus package, and possibly increase stimulus through 2019, our view is that Europe will have a very difficult 2019/20.

4. Emerging market performance

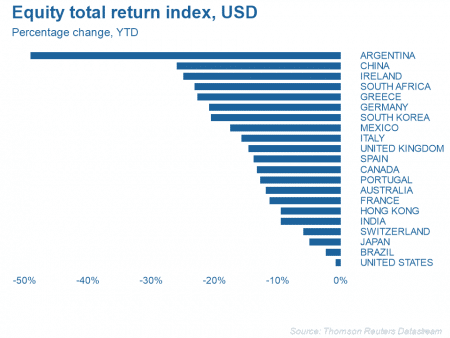

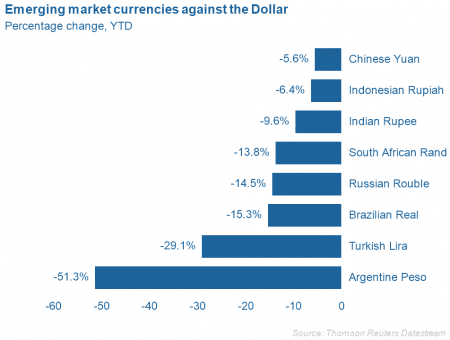

2018 has been a horrid year for Emerging market (EM) economies due to the strength of the United States Dollar (USD), in combination with the US-Sino trade negotiations.

As written previously (Emerging Market Anguish – September 2018), the implications of a strengthening USD on EM economies are significant. Due to the levels of USD borrowings held by EM economies, an appreciating USD make their debt levels increase, as well as the amount they are obligated to pay back in their local currency. This has been a major cause of this year’s EM currency devaluation (refer to Chart 4).

As stated earlier, looking ahead for 2019, an anticipated rate cut from the United States (US) Federal Reserve, as well as a slow-down in the US economy, should provide downward pressure on the US dollar. This downward pressure should benefit EM economies by reducing their debt burden, reducing their payment obligations and by making the commodities, goods, and services they are purchasing relatively cheaper.

Our view is that if there are no systemic issues in the US, Europe and China, the strongest EM economies should outperform during 2019 considering the above factors and their present valuations.