Weekly Update | July 12, 2024

Let’s hop straight into five of the biggest developments this week.

1. New Zealand holds official cash rate at 5.50%

Restrictive monetary policy has significantly reduced consumer price inflation, with the RBNZ expecting headline inflation to return to within the 1 to 3 percent target range in the second half of this year. The commentary released from the RBNZ is the first time they have turned dovish, which the markets took as a bullish and significant change.

2. Chinese CPI declines to 0.2% y/y

China’s consumer price index (CPI), a key gauge of inflation, grew by 0.2 per cent year on year in June, compared to an increase of 0.3 per cent in May. The consumer price growth marginally fell short of expectations in June, continuing the year of weakness seen in inflation. Chinese analysts have still predicted a faster recovery in the coming months as demand for residential services consumption improves.

3. UK Real GDP grows by 0.9% for the 3 months to May 2024

This is the strongest three-monthly growth since January 2022. Services output was the main contributor, with a growth of 1.1% in this period, while production output showed no growth and construction fell by 0.7%. We continue to see that the theory of a soft landing seems to be playing out reasonably well in the British economy.

4. US Core CPI rises to 0.1% but misses expectations of 0.2%

The June consumer price inflation report was surprisingly soft and should go some way to boosting the confidence of individual FOMC members that inflation is on the path to the Federal Reserve’s 2% target. Headline CPI fell 0.1% month-on-month rather than rise 0.1% as predicted while core CPI came in at +0.1% m/m versus the +0.2% consensus forecast. This data release confirms the view that rate cuts may be around the corner in the UK economy.

5. US weekly unemployment claims drop to 222k

The advance figure for seasonally adjusted initial claims was 222k, a decrease of 17k from the previously revised level. The recent trend for this data has been relatively flat over the last 12 months, as the US economy continues to absorb higher interest rates.

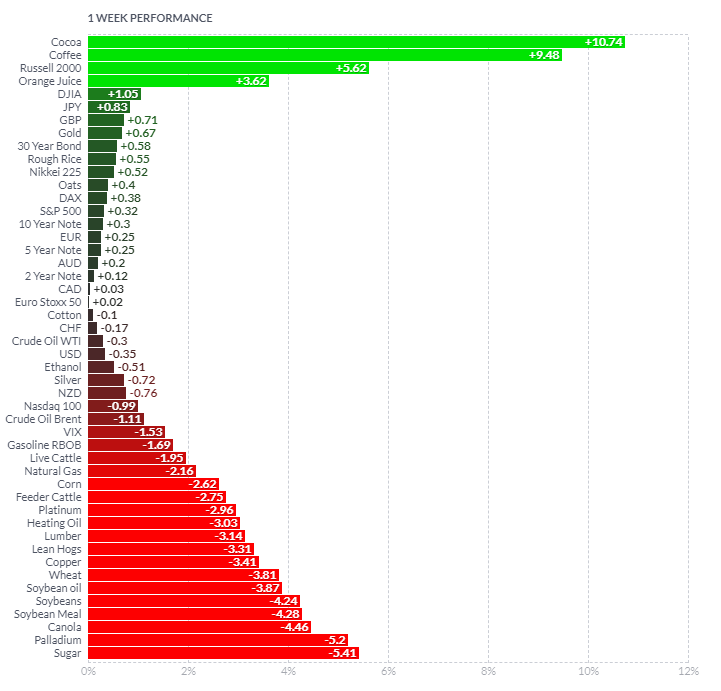

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

It certainly has been a wild few week for most commodity markets we track, as weather, crop forecasts and consumer demand, continue to move prices. Cocoa has risen over 10% in the last week as poor growing conditions in Brazil drive prices higher. Coffee experienced similar news flow to Cocoa and rose ~10% for the week. In equity markets, the Russell 2000 finally had a week of solid performance, which has been the inverse to recent sentiment. This was after CPI missed expectations well, and a gaff by Biden (welcoming Putin vs Zelensky) this morning, meaning people believe Trump being elected is a done deal. This would generally benefit oil stocks, and small to mid-cap companies. On the other end of the ledger, Sugar, Palladium, Canola and most other soft commodities sold off, as most experienced profit taking or revisions to poor weather reports.

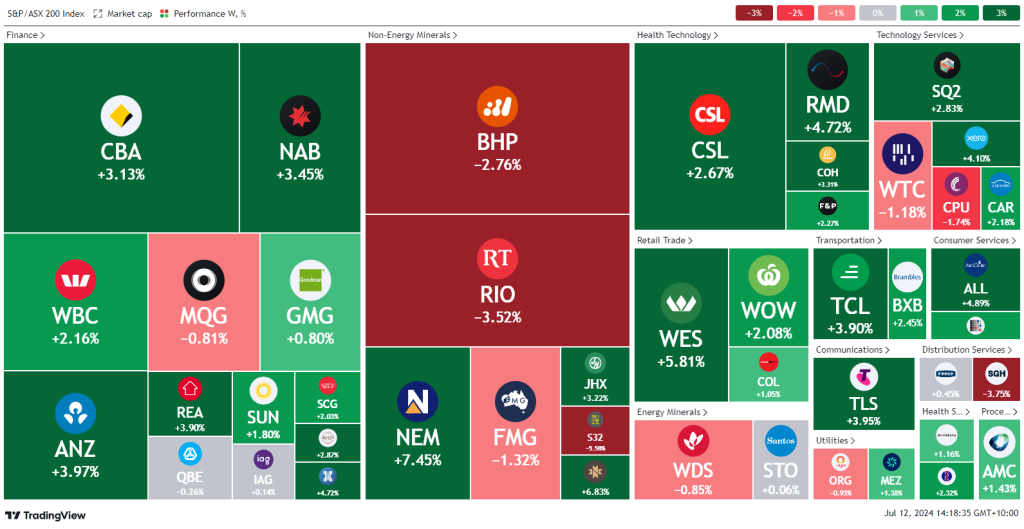

Here is the week’s heatmap for the largest companies in the ASX.

The ASX has finally played catch up to most other global equity markets. With the RBNZ pivoting from hawkish to Dovish, traders then focused on the XJO as a place to deploy excess cash reserves. The Banks continued to move higher, with CBA, NAB, WBC and ANZ all up over 2.5%. BHP and RIO experienced some profit taking after they had a couple of solid weeks of performance. In general, the rest of the ASX top 50 had good weeks of performance, with RMD, TCL, WES and TLS all leading the way.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.