Are equities currently expensive and is now a good time to invest?

We have been asked this question often by investors who are searching for a return above cash, especially in this low yielding environment. To shed light on this topic, we focus on interest rates.

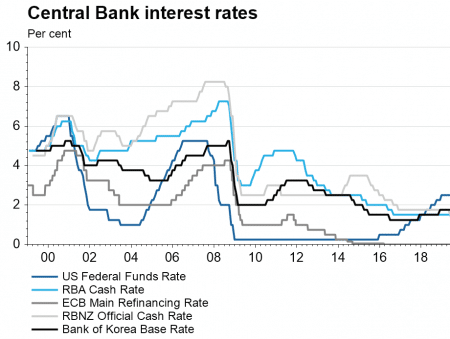

Globally, interest rates are at historical lows. Locally, the Reserve Bank of Australia (RBA) Cash Rate is at 1% (just 2 months ago it was 1.5%). The New Zealand Official Cash Rate (OCR), the Euro Refinancing Rate and the United States Federal Funds Rate are 1.5%, 0.00% and 2.25%- 2.5% respectively. The Bank of Korea also recently cut their base rate from 1.75% to 1.5%.

Most central banks have restarted accommodative monetary policy in an attempt to stimulate slowing global growth. Some market participants attribute this slowing growth to the global trade war, while others conclude that this is a natural period following a 10-year expansion. With global interest rates at record lows (and expected to go lower), the investment decision of holding cash and term deposits is not as rewarding as it once was.

Interest rates are used by Central Banks as a key tool to manage monetary policy and assist in stimulating economic growth, however for market analysts, they are a key input into valuation models. Often, when valuing equities, a discounted cash flow methodology is applied. This method forecasts a company’s cash flows into the future and discounts them by applying a discount rate, as is required by the time value of money concept. As the discount rate decreases, the value of future cash flows will be higher in today’s terms and all else being equal, companies will have lower PE ratios. Therefore, if interest rates decrease and the price of the equity remains constant, PE ratios should also decrease. This is a simple, yet certainly not the only, explanation for why we see equity prices rise when a central bank implements a more accommodative policy stance.

How do low interest rates impact investment decisions?

At some stage, investors capitulate and allocate additional capital to equities or higher yielding assets, even if it does mean tolerating additional risk (risk premium). Rather than investing in 30-year United States (US) treasuries which yield 2.57% (as at 26.07.19), investors may invest in National Australia Bank (NAB.AX) for instance, yielding 6.36%. The difference between the two is the risk premium. In the current low interest rate environment, additional risk taking is necessary to generate higher returns.

What are current equity valuations?

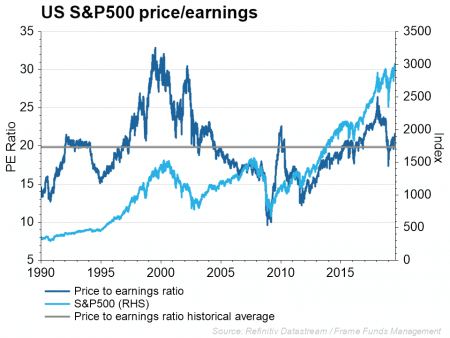

If we compare the current to historical Price to Earnings (PE) ratios for the Australian S&P/ASX 200 and the US S&P 500, both markets are slightly above their historical averages.

With the PE ratios of both markets trading above their historical average, does this mean that markets are expensive?

Not necessarily. The ratio is simply a measure of investor’s willingness to pay for earnings. In the current macroeconomic environment, as interest rates fall, equity prices go up to factor in the relatively higher future earnings of companies and the more accommodative funding markets. If it is anticipated that interest rates will fall, equity markets will bid up the price of equities before this happens, raising PE ratios, which should then stabilise when an interest rate cut is realised.

To summarise

From the perspective of most listed companies, lower interest rates are a good thing. Debt is easier to come by and the repayment obligations of that debt is less. Spending by companies may increase, which will generally imply higher growth rates, reducing PE ratios. In this stance market analysts will increase growth expectations and generally equity prices will continue to rise.

As Warren Buffett said in May, ‘I think stocks are ridiculously cheap if you believe…that 3% on the 30-year bonds make sense’. From an investor’s perspective, consistently low interest rates does encourage risk taking, up until the point where investors are unwilling to take on risk for additional investment returns.