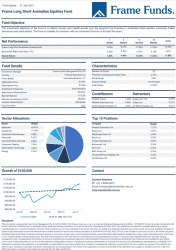

Units of the Frame Long Short Australian Equity Fund decreased -3.76% in September. Comparatively the S&P/ASX200 declined -2.69% for the month.

The benchmark Australian index snapped its 11-month winning streak in September, as global equity markets finally succumbed to selling pressure. Concerns around a weakening Chinese economy drove the profit taking, in combination with news that real estate giant Evergrande is teetering on the brink of collapse. As the market digested the implications of possible credit contagion and a slowdown of the Chinese property sector, investors aggressively sold off Australian materials businesses. The sector declined by -12.1% for the period, with iron ore companies experiencing the brunt of the selling.

In terms of Fund activity, September was a busy month. We began to reduce our exposure to the materials sector when it became apparent worries surrounding the Chinese economy may persist for longer than anticipated. The focus was on reducing our investments in companies that were exposed to Chinese iron ore demand or the steel industry. It is our view that these investments will be subject to significant short-term volatility with limited upside potential due to the risks stated above. We initiated investments in South32 Limited (ASX: S32) and Alumina Limited (ASX: AWC) as they look poised to benefit from aluminium shortages in the medium term.

Top equity contributors were Oil Search Limited (ASX: OSH), Whitehaven Coal Limited (ASX: WHC) and NewsCorp (ASX: NWS), which contributed +0.67%, +0.40% and +0.38% respectively. Oil Search benefitted from rising crude prices, as OPEC+ remained firm on production levels despite increased demand. Whitehaven rose with coal prices, as strong demand from Asia looks set to continue until 2025.

Similar to last month, investments in materials companies detracted from performance as money continued to flow out of the sector. BlueScope Steel Limited (ASX: BSL), Mineral Resources Limited (ASX: MIN) and Fortescue Metals Group (ASX: FMG) detracted from performance by -0.89%, -0.86% and -0.70% respectively. Materials remains our heaviest weighted sector, however our allocation has decreased to 24%. At the conclusion of the month, the Fund held approximately 36% in cash.

The full report can be downloaded by clicking the image below.