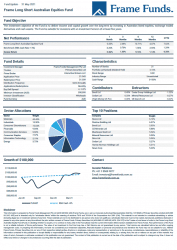

The Frame Long Short Australian Equity Fund declined -0.35% in May. Comparatively, the S&P/ASX 200 rose +1.93% for the period.

May saw volatility in commodity markets spill over into equity markets. This resulted in the expansion of the trading range for the S&P/ASX 200. After closing at an all-time high on the 10th, the index proceeded to decline by 3.5% as an aggressive sell-off led by iron ore, coal, and steel sparked profit-taking in the overbought materials sector. The selling began with Chinese officials voicing concerns over the prices of raw materials, as well as increasing trading limits and margin requirements on some iron ore contracts. Profit-taking appeared to be short-lived however as investors took the opportunity to accumulate at lower levels. Boral Limited (ASX:BLD), Codan Limited (ASX:CDA), and Virgin Money (ASX:VUK) were the Fund’s top contributors as they continued to trend higher and make new 52-week highs. Their approximate contributions were +0.45%, +0.33% and +0.30% respectively.

Costa Group (ASX:CGC) was sold off aggressively after their AGM market update. The update cited labour market shortages and only a marginal increase in first-half performance compared to 2020. CGC detracted approximately -1.32% from the Fund’s performance. This is, unfortunately, an unavoidable part of participating in equity markets – investors will always have differing opinions on company updates which can result in somewhat confusing price moves. Mineral Resources (ASX:MIN) and Oil Search (ASX:OSH) detracted -0.27% and -0.22% respectively. Their declines can also be attributed to the commodity price volatility mentioned above.

The material sector remains our largest weighting at 43.45%. We believe the selling and subsequent rebound in commodities mid-month is proof of the underlying strength of the sector. The Fund continued to build positions in our basket of materials companies. Additionally, we took advantage of discretionary trading opportunities in Latitude Consolidated (ASX:LCD) and ASX200 Index Futures.

At the end of May, the Fund held 21 investments.

The full report can be downloaded by clicking the image below.