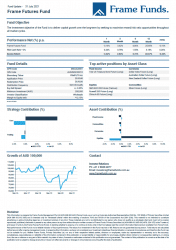

Units of the Frame Futures Fund declined by -2.17%. The core strategy under-performed, it declined by -2.87%.

The trading strategy contributed +0.69%. Equity and Commodity investments detracted approximately -2.38% and -0.30% respectively, while Currencies and Fixed Income investments rose by +0.48% and +0.27% respectively.

Global equity markets sold off aggressively due to a combination of factors. The yield on 10 & 30 year US treasuries continued to rise, which gave investors a reason to start positioning their portfolios for higher interest rates in the future. During the month we also saw Chinese property giant Evergrande, move to the brink of a collapse, as they failed to make their debt repayments. These factors caused the S&P500 to slump by -4.65%. The Australian share market was the relative out-performer, only declining by -2.69% for the month.

Largest contributors to the performance were our active trading strategies on the S&P/ASX 200 future contract (+2.45%) and our investment in Liontown Resources Ltd (+1.85%). Our investment in Fortescue Metals Group was the largest detractor to performance once again, however we remain positive on the long-term outlook for the business.

In terms of fund activity, we started to accumulate positions in a variety of ASX-listed Nickel companies. We also continued to reduce the number of holdings in businesses where our level of conviction had waned. We used the sell-off in US equities as an opportunity to increase our holdings in the Nasdaq and the Russell 2000.

At the conclusion of the month, the Fund held 24 investments.

The full report can be downloaded by clicking the image below.