For this month’s edition of Stocks in Play we have focused on a selection of three companies held within the Frame Long Short Australian Equity Fund.

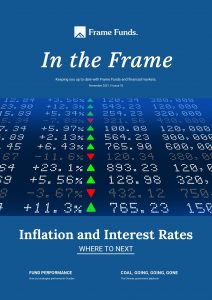

Whitehaven Coal (ASX: WHC)

Whitehaven Coal have had a very strong 4 months thanks to significantly higher coal prices. Whitehaven have cited increased demand from Asia, which has the youngest fleet of coal fired power stations in the world.

Heightened industrial production thanks to the COVID-19 recovery has also assisted their profitability and in turn, their share price. Global coal demand is expected to be strong until 2025.

After the release of their FY21 results, WHC are focusing on debt reduction and optimising mine productivity to service the strong demand for coal.

We believe Whitehaven still has room to move higher in the medium to long term, however we are looking for the share price to consolidate in the short run.

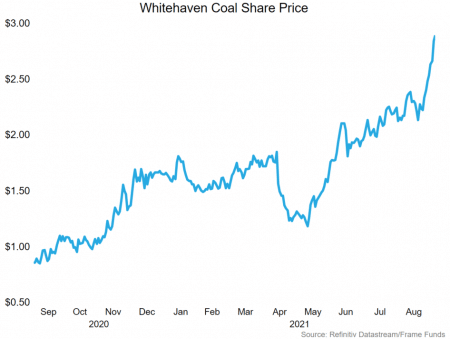

Blackmores (ASX: BKL)

Blackmores is another company that performed strongly after the release of their FY21 results as their share price increased as much as 25%.

Expansion into Asian growth markets proved to be successful for Blackmores, with revenue and gross profit margins both increasing. We believe the COVID-19 pandemic has led to a paradigm shift in the way the world views health and wellbeing. More emphasis has been placed on staying mentally and physically healthy which has naturally benefitted Blackmores vitamins and supplements business.

We believe their continued investment in global supply chains leaves them perfectly positioned to capitalise on a more considered approach to health, particularly in South-East Asian markets.

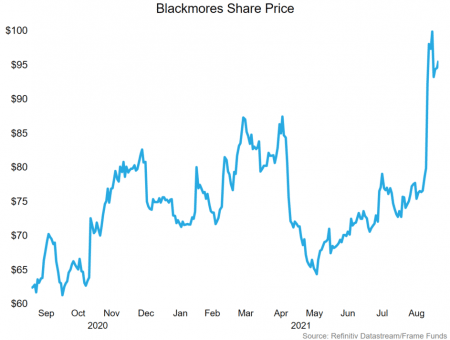

Premier Investments (ASX: PMV)

While Premier Investments has not yet reported their results for the 2021 financial year, we believe they are very much in play once they report.

While their holdings will be negatively impacted by the current lockdowns, we expect their guidance will be upbeat as the Australian economy begins to reopen with high levels of vaccination.

There remains a high level of household savings and suppressed demand in the economy and we believe once stores reopen, cash rich consumers will be ready to spend in the retail space. Especially in Smiggle, as children return to school. We also believe online distribution channels will have partially offset in-store sales losses during the lockdowns.

Download the full report by clicking the image below.