Weekly Update | May 31, 2024

Let’s hop straight into five of the biggest developments this week.

1. Australian retail sales decline to 0.1% m/m

The April 2024 seasonally adjusted estimate rose 0.1% m/m. Other retailing was one of the largest contributors, rising 1.6% m/m, while clothing, footwear and personal retailing declined by -0.7%. This number demonstrates that higher interest rates are slowly starting to work their way to the consumer.

2. US CB Consumer Confidence rose to 102 vs 96 expected

Confidence improved in May after three consecutive months of declines. Consumers’ assessment of current business conditions was slightly less positive than last month; however, the strong labour market continues to bolster consumers overall.

3. Australian CPI rises to 3.6% y/y

The monthly CPI indicator rose 3.6% in the 12 months to April. The most significant price rises were in housing (+4.9%), food and non-alcoholic beverages (+3.8%), alcohol and tobacco (+6.5%) and transport (+4.2%).

4. German Prelim CPI rises 0.1% m/m

German inflation rose 0.1% m/m in May which demonstrated the stickiness of inflation within the entire Eurozone. Headline inflation came in at 2.4% year-on-year, up from the 2.2% YoY in April but still below the 2.5% YoY recorded in February. The increase in headline inflation was mainly triggered by higher services inflation as a result of a reversed base effect from last year’s introduction of cheap public transportation.

5. US unemployment claims steady at 219K

The number of Americans applying for unemployment benefits ticked up last week, but layoffs remain historically low in the face of lingering inflation and high interest rates. Jobless claims for the week ending May 25 rose by 3,000 to 219,000, up from 216,000 the week before.

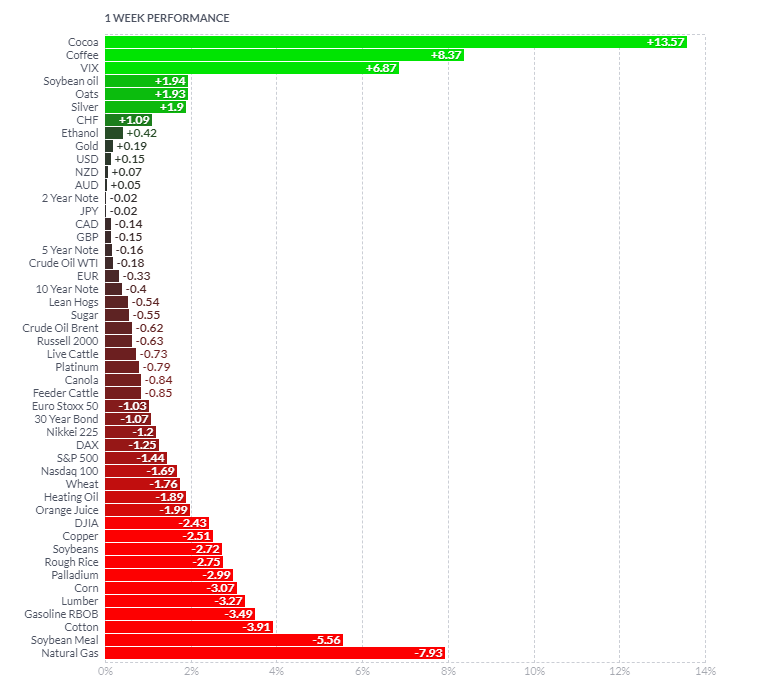

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Cocoa & coffee continue to experience large week to week volatility as weather and supply forecasts continue to drive prices higher. Natural Gas sold off over the course of the week as forecasts for a warmer summer were announced. The majority of other commodities experienced mild retracements. No specific data drove these moves, but recently most of these commodities experienced reasonable upwards moves. Equities had a choppy weak with the Nasdaq, Dow and the S&P 500, all down > 1.4%.

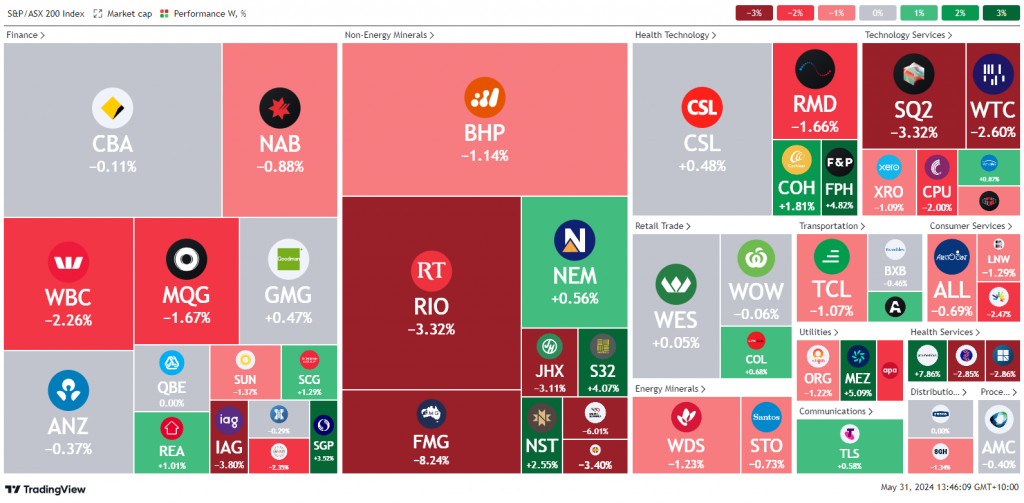

Here is the week’s heatmap for the largest companies in the ASX.

The Australian share market had a period of poor performance over the last week driven by interest rate cut expectations. BHP, RIO and FMG all sold off, as iron ore experienced a retracement. The banks were flat to lower, with WBC the worst performer. Green shoots generally came from NST, S32 and NEM, which all rebounded with gold and aluminium prices. Other than that, the market has had a very choppy period and is trying to find its feet into the end of the financial year.

The Australian share market had a period of poor performance over the last week driven by interest rate cut expectations. BHP, RIO and FMG all sold off, as iron ore experienced a retracement. The banks were flat to lower, with WBC the worst performer. Green shoots generally came from NST, S32 and NEM, which all rebounded with gold and aluminium prices. Other than that, the market has had a very choppy period and is trying to find its feet into the end of the financial year.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.