Weekly Update | March 10, 2025

1. US ISM Services PMI rises to 53.5 beating forecasts of 52.5

The US ISM Services PMI climbed to 53.5 in February, exceeding forecasts of 52.5. This indicates that there is continued expansion in the services sector, which makes up roughly 77% of the US economy. However, rising service-sector activity could contribute to persistent inflation, possibly delaying Federal Reserve rate cuts.

2. Australian GDP Q4 meets expectations of 0.6%

Australia’s GDP expanded by 0.6% in Q4, matching forecasts and reflecting moderate economic resilience despite high interest rates. Household consumption remained weak due to rising mortgage repayments and cost-of-living pressures, while government spending and exports provided support. This strong number will make the RBA cautious on the path of interest rates.

3. European Central Bank cuts rates to 2.65%

The European Central Bank lowered interest rates to 2.65%, in an attempt to support economic growth amid slowing inflation and weak demand. This move could boost borrowing, investment, and consumer spending over the next six months. However, with sluggish GDP growth and geopolitical risks, the recovery may be gradual. Markets will watch inflation trends to gauge future policy direction.

4. US unemployment claims decline to 221K vs 234K expected

US unemployment claims fell to 221K, beating expectations of 234K. This signals a strong labour market. Lower claims suggest steady job growth and economic resilience, which could support consumer spending over the next six months. However, a tight labor market may keep wage pressures elevated, complicating the Federal Reserve’s inflation fight and potentially delaying interest rate cuts.

5. US average hourly earnings 0.3% m/m vs 0.3% expected

Wages grew by 0.3% on the month to an average of $35.93 per hour. They were up 4.0% on the year, and 3.6% over the last three months. This data continues to show that there is strength in the labour market, however, there seems to be a little heat leaving the labour market. This will need to be monitored by the US Federal Reserve to ensure any slow down occurs gradually.

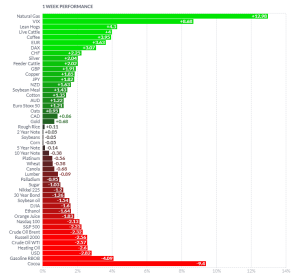

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Recently it seems to be a very common trend, volatility is high…everywhere. There seems to be many moving parts across global markets with commodities, bonds, equities and currencies all swinging around. Last week natural gas was the best performer, as it rose +12.98% due to cooler weather forecasts. The EUR & the DAX 40 both rose +3.63% and +3.07% respectively, with the large issue of government bonds, being the catalyst. The Dow, Nasdaq and S&P 500 all fell > -1.6%. Cocoa was the worse performer, as rain forecasts in Brazil are expected to increase supply in the coming seasons.

Here is the week’s heatmap for the largest companies in the ASX.

I feel like I have been saying this an awful lot lately, however I will say it again, the markets are volatile! Depending on the week, we are seeing whacky movements higher and lower, depending on tariff news, interest rate cuts or economic data. This last week was not different, as markets aggressively swung higher and lower depending on news out of the US. The banks were sold off aggressively once again, with CBA, NAB, WBC and ANZ all down over -3%. MQG also suffered dropping -7.44%. Defensive names such as TLS were comparatively outstanding, they rose +1.71%. Australian tech was sold off aggressively as the Nasdaq selling reached our market. WTC, XRO and CAR were down -3.02%, -4.58% and -4.78% respectively. Materials and healthcare were solid as RIO, NEM, CSL and COH were mostly flat to higher. Consumer staples, WES, WOW and COL were all hammered dropping -4.28%, -6.05% and -7.37% respectively.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.