Over February, most global equity markets rallied, however were choppy over the course of the month as yields of 5 & 10 year United States (US) Treasuries increased. This increase in yields provided some uncertainty to investors that the US Federal Reserve may be too accommodative with their monetary policies. The Australian share market also experienced volatility during the month, however, was a beneficiary of having such large weightings in banks, who are generally thought to benefit from rising rates.

Solid Rebound

Both the global macro and long short Australian equity strategies experienced positive months for February 2021. The Frame Futures Fund generated 2.21% whilst the Frame Long Short Australian Equity Fund had a strong month of performance, rising 8.53%. Although I was satisfied with the performance of both strategies, under the surface our investments experienced significant volatility through out the month. The global macro strategy, benefited from our exposure to global equities, however suffered losses in fixed income, commodity, and currency investments. The 3 & 6-month performance figures for the Frame Futures Fund are 5.13% and 17.37%. The long short Australian equity strategy, rebounded strongly after last months end of month 3-day sell off. This rebound takes the Frame Long Short Australian Equity Fund 3-month performance to 8.46%.

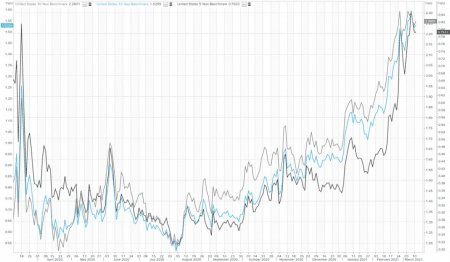

Yields, Yields, Yields

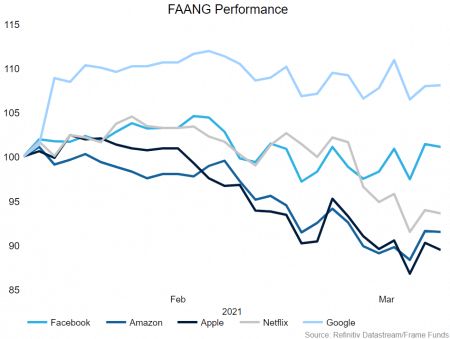

During February 10-year US Treasury yields gradually climbed, going from 1.079% to 1.395%. This jump saw an increase in the speed at which money was allocated away from high growth, high valued tech companies, into higher yielding, lower valued companies like financials. This rotation can be seen during February with the Nasdaq down -0.123%, whilst the Dow Jones was up 3.168%. I interpret this move in yields positive for the market over the medium term, as it shows that both equity and markets are both in agreement that the underlying health of the economy is recovering. However, in the short term, I would continue to expect to see more volatility as investor repositioning occurs.

Market Volatility

Since the start of the year, volatility across global investment markets has increased significantly. We saw the Gamestop (GME) induced sell-off at the end of January, Tesla Inc (TSLA) & Apple Inc (AAPL) decline by ~20%, domestic banks rallying aggressively (WBC rose 12.27% in February alone) and most recently the extreme spikes in the 5 & 10-yr yield. In times like these, our focus is on determining if for the positions we hold, the tide is going in or going out, rather than focusing on the day-to-day volatility.

Outlook

March brings with it the conclusion of the domestic reporting season. We will take stock and analyze how our businesses reported during February and possibly tweak our position sizing. Also, with the spike in yields mentioned above, it is also a good opportunity to review our investment themes for 2021 and ensure that in an environment with increasing interest rates, our macroeconomic positioning is suitable.

If you would like to discuss any of the points in this newsletter, please call our office on 02 8668 4877.

Hue Frame

Managing Director

Past performance is not an indicator for future performance. This is not intended to be financial advice and does not take into account any particular person’s circumstances. Before relying on this information, please speak to an independent financial adviser.