Weekly Update | July 26, 2024

Let’s hop straight into five of the biggest developments this week.

1. Chinese 1-year loan rate drops to 3.35%

The People’s Bank of China (PBOC) cut a key short-term policy rate for the first time in almost a year, stepping up support for the economy after growth disappointed. The seven-day reverse repo rate was lowered by 10 basis points to 1.7%, while the 5-year loan prime rate declined to 3.85%. This action showed that the PBOC is going to be active in providing economic support.

2. Eurozone flash manufacturing continues its broad decline

On Tuesday a raft of PMI data points was released out of the Eurozone and broadly they all continued their downtrend. German Flash Manufacturing declined to 42.6, which was the lowest reading in 3 months. The only bright spot was French Services PMI which moved into expansionary territory (50.7), for the first-time since April.

3. Bank of Canada drops rates by 0.25% to 4.50%

The Bank of Canada today reduced its target for the overnight rate to 4.50% saying that they feel that they have managed to get inflation under control, while expecting their balance sheet to continue to normalize. The cut is the second of the year, which shows the BOC’s commitment to maintaining their economic growth.

4. US GDP rises to 2.8% vs expectations of 2.0%

Real gross domestic product (GDP) increased at an annual rate of 2.8% in the second quarter of 2024, according to the “advance” estimate released by the U.S. Bureau of Economic Analysis. The increase in real GDP primarily reflected increases in consumer spending, private investment and non-residential fixed investment. All these factors provide support to the argument that the US economy is continuing to move forward.

5. US new core durable goods orders rise to 0.5% m/m

US core durable goods beat expectations of a 0.2% increase in the prior month; however, transportation provided a large drag on the reading. Transportation equipment plunged by 20.5%. Similar to point 4, this data point, demonstrates that consumers and businesses continue to spend.

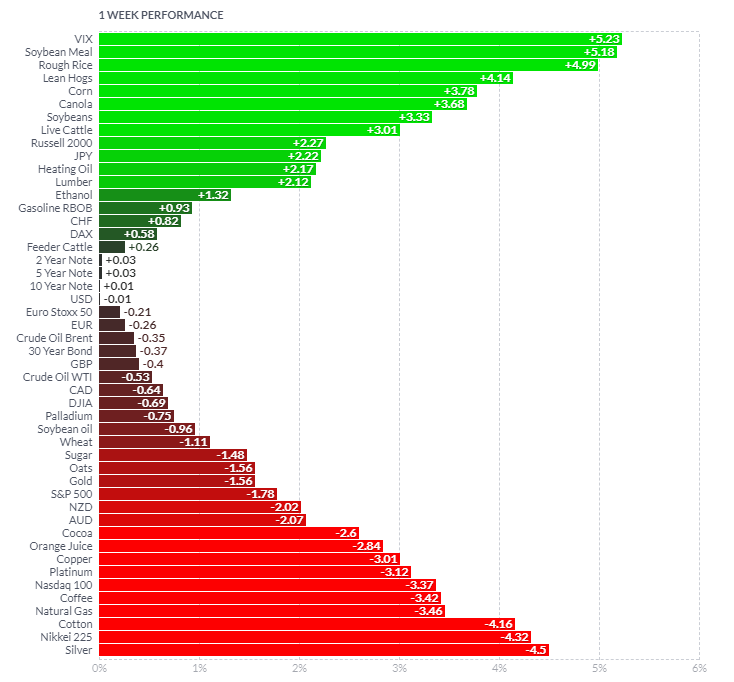

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

On the surface, our universe has stayed relatively consistent over the last week, with the VIX, Soybean Meal, and Rough Rice being the best performers. The VIX rose as equity markets sold off, as investors hunted for a safe haven. Soybean Meal and Rough Rice futures rose as poor weather conditions meant participants positioned for less supply in the upcoming season. Silver was the worst performer over the week. We can’t see any particular reason for this profit-taking. The Nikkei 225 was the worst equity market performer, as it declined by over -4%. This was mostly due to a strengthening JPY.

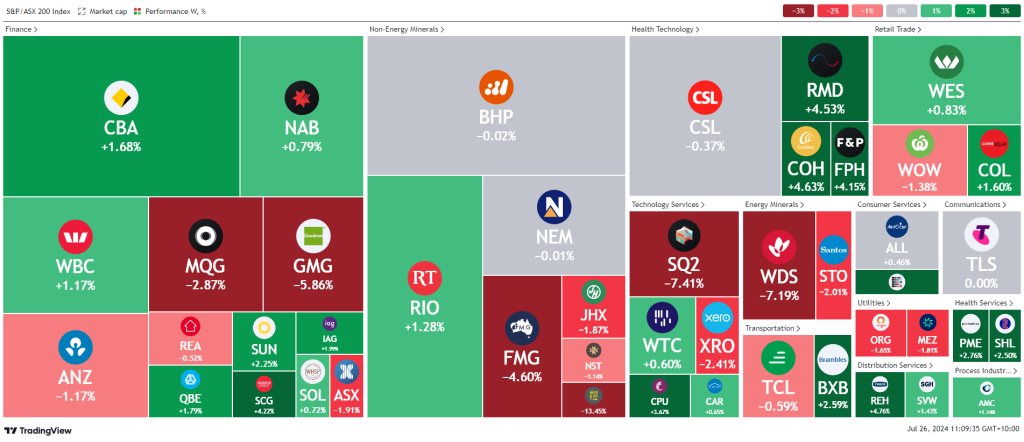

Here is the week’s heatmap for the largest companies in the ASX.

Over the last week, we have certainly seen some volatility within global equity markets, and the ASX has not been spared. That being said, we have continued to see pockets of the market do well. Financials continue to support the broader index, with CBA, NAB, and WBC all rising by ~1%. BHP, RIO, and FMG were all very mixed, with RIO the best performer, as it rose 1.28%. FMG was the worst as it declined by -4.63%. Healthcare was one of the strongest pockets of the market, as investors flocked to more defensive names not related to commodity prices or technology.

Over the last week, we have certainly seen some volatility within global equity markets, and the ASX has not been spared. That being said, we have continued to see pockets of the market do well. Financials continue to support the broader index, with CBA, NAB, and WBC all rising by ~1%. BHP, RIO, and FMG were all very mixed, with RIO the best performer, as it rose 1.28%. FMG was the worst as it declined by -4.63%. Healthcare was one of the strongest pockets of the market, as investors flocked to more defensive names not related to commodity prices or technology.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.