Weekly Update | July 21, 2023

It has been another busy week in the Frame Funds offices, with statistical testing and strategy refinement as the focus (our reversion strategies in particular).

Let’s hop straight into five of the biggest developments this week.

1. China’s GDP q/y grows at 6.3% vs 7.1% expected

China’s post Covid-19 recovery has slowed. They posted a 6.3% growth in the second quarter for the annual benchmark. Markets were disappointed with the number as expectations were for 7.1%, however it did improve from the prior months reading of 4.5%. Consumer confidence remains relatively weak as a global slow-down impacts exports.

2. US core retail sales grew 0.2% in June

Despite resilience that was marked by the third straight monthly growth in US core retail sales, the rate continued to decelerate. Growth in the retail sector fell to 0.2% from the previous upward revised figure of 0.3%, falling below the market expectation of a 0.4% gain. The inference is that the elasticity in pending power of consumers is slowly reaching its limits as high interest rates begin to work their way into the economy.

3. New Zealand CPI q/q rose 1.1% in Q2 of 2023

The Inflation headache in New Zealand persisted in the second quarter of 2023 at 1.1%, which beat market expectations of 0.9%. Although a marginal fall from the first quarter, inflation remains endemic with the annual figure remaining sticky at 6%. Food and housing are the most significant contributors to inflation and markets expect further financial policy tightening by the RBNZ in the coming months.

4. UK CPI y/y fell to 7.9% in June

The rate of deflation continues to pick up momentum in the UK, as the reading came in at 7.9% vs expectations of 8.2%. The release marked the fifth consecutive decline in inflation statistics, pointing to the overall impact of the BOE’s financial policy to mitigate inflation. Inflation in the UK remains by far one of the highest of the developed economies. Price stability in petroleum products was the most consequential contributor to the slump from the previous 8.7% inflation figure.

5. Australian employment change surged 33.6K

The Australian labour market posted better than expected results on Thursday. The employment change of 33.6k beat expectations of 15.4k. This drove the AUD/USD higher by around 1%. With the unemployment rate subdued at 3.5%, it was notable that Australia was creating more jobs than expected, giving the RBA greater leverage in its monetary policy interventions.

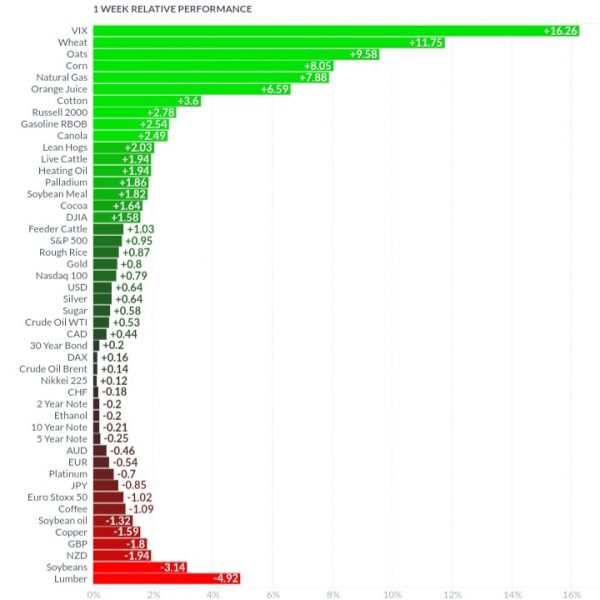

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Quite the opposite from last week with the VIX being the biggest gainer, vs the biggest loser the prior week. Growth data from China and large cap US company reports missed expectations which ignited the rise in the VIX. Grain markets continued to experience large swings, production, weather and Russia withdrawing from the Ukraine deal that allowed them to export across the Black Sea, compelled wheat, corn and oats higher. Copper declined on growth worries, while the energy complex continued to gradually rise. Interesting to note that the majority of commodities within our tradeable universe are hitting new short-term highs. A soft landing is generally not deflationary, which we can see directly from the price action above.

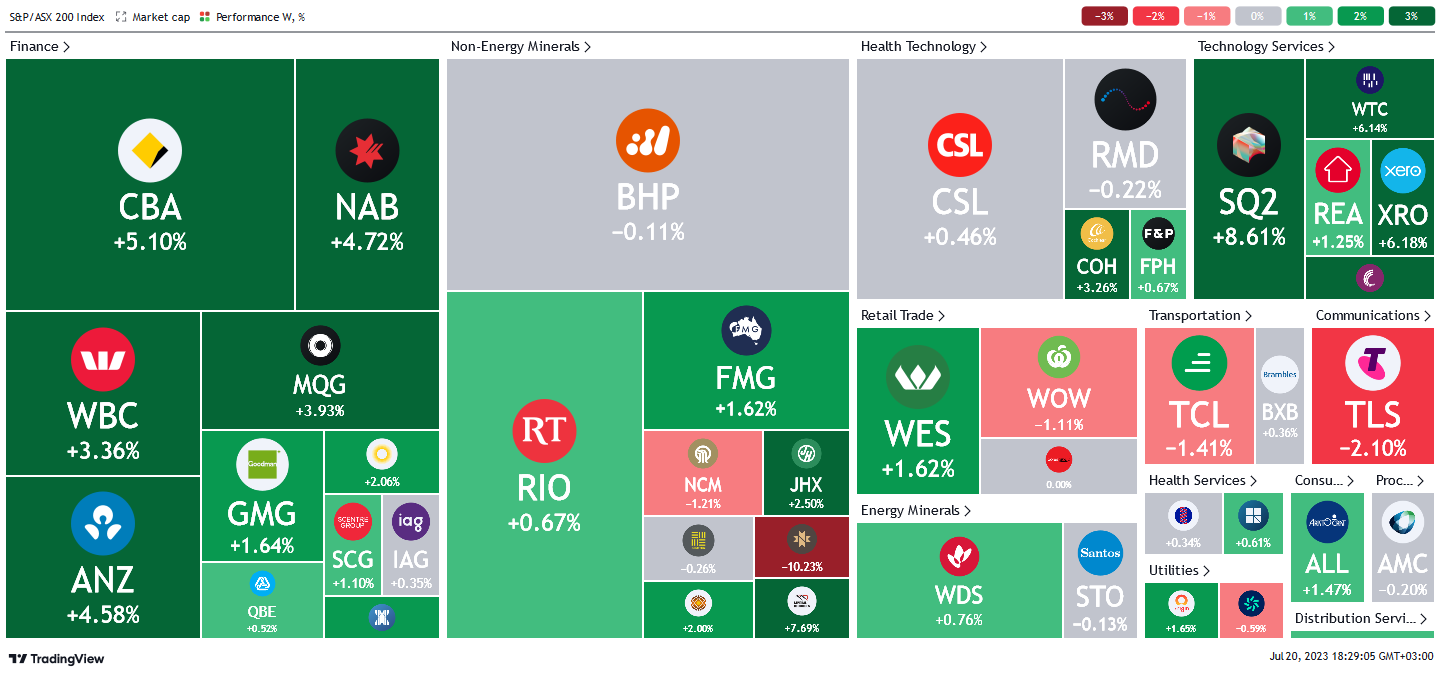

Here is the week’s heatmap for the largest companies in the ASX.

A very upbeat week for the ASX. The financial sector lead the charge after thawing inflation raised possibility for a rates pause with CBA, NAB and WBC outperforming. Miners experienced a flat week in general, due to the softening Chinese data. The technology sector rallied to far outperform the index while health care stocks were mixed. The general theme once again, was a rotation from defensive companies into companies which were more cyclical in nature.

A very upbeat week for the ASX. The financial sector lead the charge after thawing inflation raised possibility for a rates pause with CBA, NAB and WBC outperforming. Miners experienced a flat week in general, due to the softening Chinese data. The technology sector rallied to far outperform the index while health care stocks were mixed. The general theme once again, was a rotation from defensive companies into companies which were more cyclical in nature.

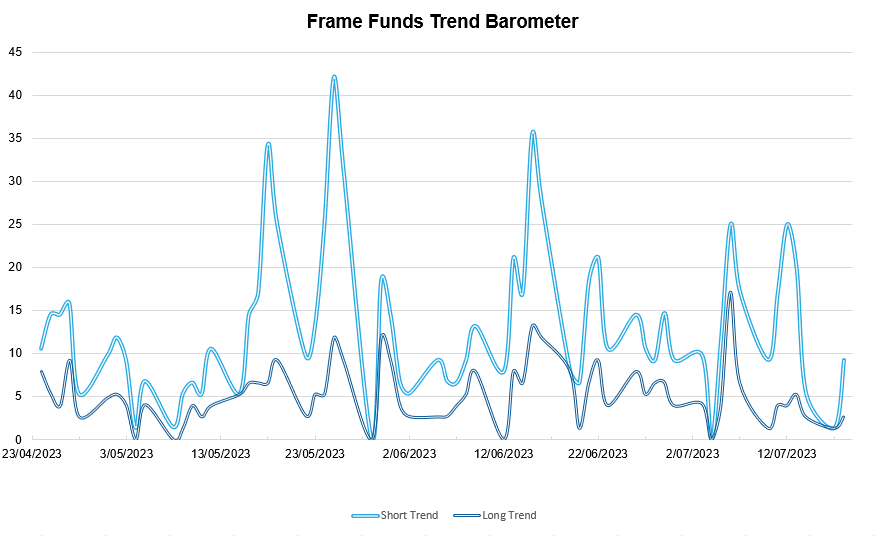

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.