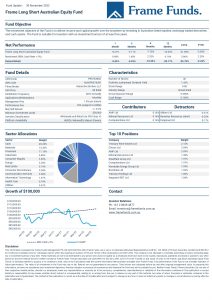

Units of the Frame Long Short Australian Equity Fund decreased -0.21% in November. Comparatively, the S&P/ASX200 advanced +6.13% for the period.

Global equity markets staged another strong month in November as most central banks followed the RBA’s ‘soft pivot’ from October. Downside surprises in global inflation data seemed to confirm this attitude, with terminal rate forecasts repriced lower around the world. The RBA is expected to lift the cash rate another 25 basis points in December to 3.10%.

Top contributors for the month were AMP Ltd (ASX: AMP), Mineral Resources (ASX:

MIN) and Computershare Ltd (ASX: CPU). They each contributed approximately +0.14%. Computershare upgraded their FY23 guidance to reflect substantial growth in Margin Income, driven by the global rising rate environment. Mineral Resources benefitted from the continued rebound in iron ore prices and robust demand in the lithium market. AMP continued its rebound, making a new yearly high for the first time since February 2015.

Largest detractors for the month were Allkem Ltd (ASX: AKE), Ramelius Resources Ltd (ASX: RMS) and Perpetual Ltd (ASX: PPT). They detracted approximately -0.31%, -0.25% and -0.17% respectively. Allkem fell as broad profit taking hit large cap lithium miners. Perpetual fell after it was announced that the Pendal acquisition would move forward. A short trade in Ramelius was covered as gold prices pushed higher.

Fund activity was elevated over the course of the month. Our longer-term strategies re-entered the market as it appeared momentum higher was broad based. Shorter term strategies trading both long and short were also busy. The Fund holds longer term positions in every sector, with materials being the highest weighted at 13.43%.

The full report can be downloaded by clicking the image below.